US stocks declined on Tuesday, as the markets are bracing for hawkish talk at the Jackson Hole event after recent comments from officials convinced many investors the Fed will continue to tighten even with a slowing economy. Apart from that, data Tuesday showed sales of new US homes fell for the sixth time this year to the slowest pace since early 2016, while business activity contracted for a second straight month. Moreover, quantitative tightening by the US central bank is set to kick into gear next month, presenting another potential headwind for equities.

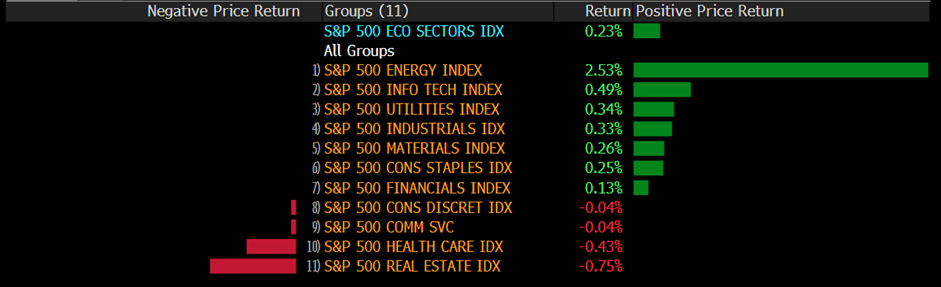

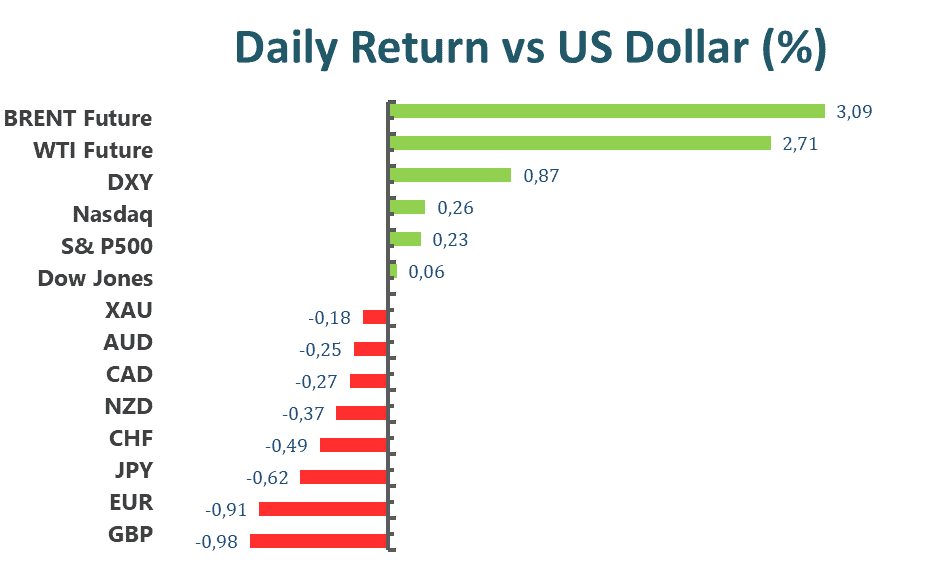

The benchmarks, both S&P500 and Dow Jones Industrial Average fell and saw their third straight drop after swinging between gains and losses throughout the session on Tuesday. Seven out of eleven sectors stayed in negative territory, as Real Estate and Health Care performed the worst among all groups, plunging with 1.45% and 1.39% losses on daily basis respectively, while Energy outperformed all the other groups, surged with a 3.62% on daily basis. The Dow Jones Industrial Average fell 0.5%, the Nasdaq 100 was little changed, and the MSCI world index decreased 0.3% for the day.

Main Pairs Movement

US dollar declined on Tuesday and failed to extend its four straight rises after data showed U.S. private sector activity was weaker than expected in August, prompting bets the Federal Reserve may be less aggressive in its rate hiking cycle. The DXY index witnessed heavy selling transactions and fell to a daily low level below 108.1 in the early US trading session, then rebounded to oscillate in a range from 108.4 to 108.7 level.

The GBP/USD surged by 0.59% daily for the day, as US economic data reignited recession fears. The cables observed fresh upbeat traction during the early US trading session following a drop in greenback caused by dismal US data. The pair touched a daily high level above 1.187, then lost bullish momentum and volatile between 1.185 and 1.181. Meantime, EUR/USD surged and touched a daily high level above 1.001. The pair advanced by 0.27% daily.

Gold surged and ended the six consecutive day drop on Tuesday, as the US dollar plunged across the board. XAU/USD gained bearish momentum and touched a daily high of $1,754 marks after an announcement of US dismal data, which may slow the pace of rate hiking.

Technical Analysis

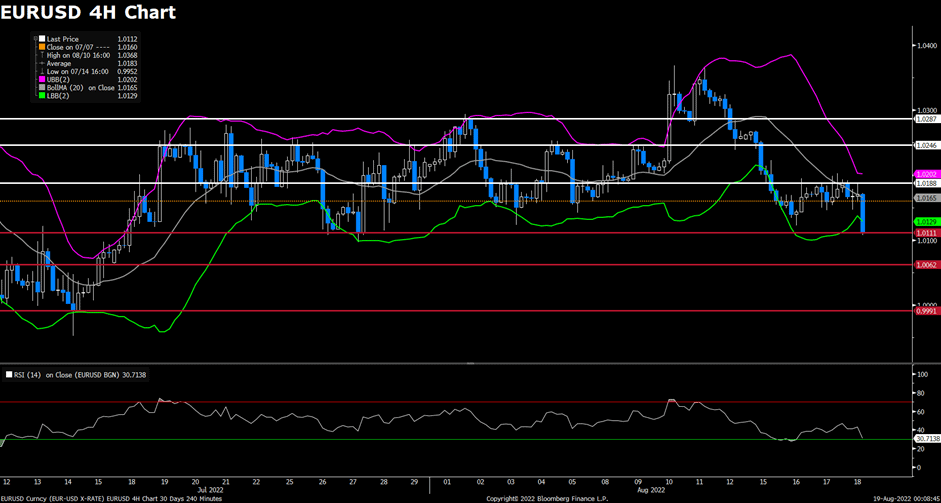

EUR/USD (4-Hour Chart)

The EUR/USD pair rebounded on Tuesday, recovering sharply from 20-year lows that touched earlier in the European session and climbed to a daily top above the 1.000 mark after the release of dismal US PMI data. The pair is now trading at 0.9971, posting a 0.29% gain daily. EUR/USD stays in the positive territory amid renewed US dollar weakness, as the release of weaker-than-expected flash US PMI prints for August exerted bearish pressure on the greenback and helped the EUR/USD pair to find demand. The US Manufacturing PMI declined to 51.3 and the Services PMI plunged to 44.1 in August, falling short of market expectations and showing that the business activity in the US private sector contracted at a stronger pace. For the Euro, the mixed Eurozone and German PMI data provide some support to the shared currency, as well as the better-than-expected Eurozone Consumer confidence that was released in the US session.

For the technical aspect, the RSI indicator is 34 as of writing, suggesting that the downside is still more favoured as the RSI stays below the mid-line. As for the Bollinger Bands, the price witnessed fresh buying and rose toward the moving average, therefore some upside traction can be expected. In conclusion, we think the market will be slightly bullish as long as the 0.9924 support line holds. The rising RSI also reflects bull signals.

Resistance: 0.9991, 1.0038, 1.0082

Support: 0.9924

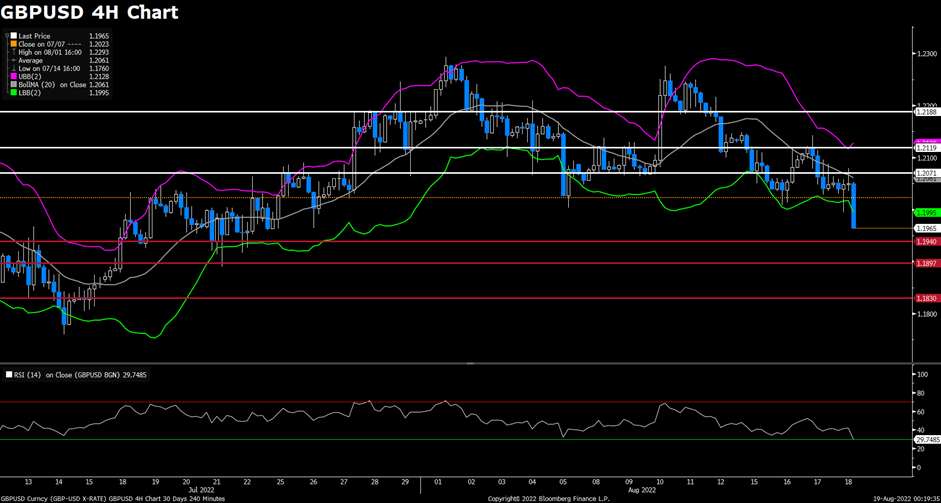

GBP/USD (4-Hour Chart)

The GBP/USD pair advanced on Tuesday, observing strong daily gains and touched a daily high above 1.1860 level during the US trading session amid the weak US economic data. At the time of writing, the cable stays in positive territory with a 0.65% gain for the day. The US Dollar Index (DXY) retreats from the monthly high and dropped to a daily low near 108.1, as the report showed that business activity in the US contracted for the second consecutive month. But the fears of recession and increasing hawkish Fed bets should limit the losses for the safe-haven greenback, meanwhile, investors expect a more hawkish message from Fed Chair Jerome Powell at the Jackson Hole symposium on Friday. For the British pound, the UK Manufacturing PMI in August also fell to 46.0, which is mainly due to supply chain disruptions and high energy prices across Europe.

For the technical aspect, the RSI indicator is 44 as of writing, suggesting that the pair has regained bullish momentum as the RSI rose sharply toward the mid-line. As for the Bollinger Bands, the price staged a rebound and crossed above the moving average, therefore a continuation of the upside trend can be expected. In conclusion, we think the market will be bullish as the pair is testing the 1.1830 resistance. A sustained strength above that level could confirm the bullish shift in the near-term outlook.

Resistance: 1.1830, 1.1922, 1.2050

Support: 1.1780, 1.1763

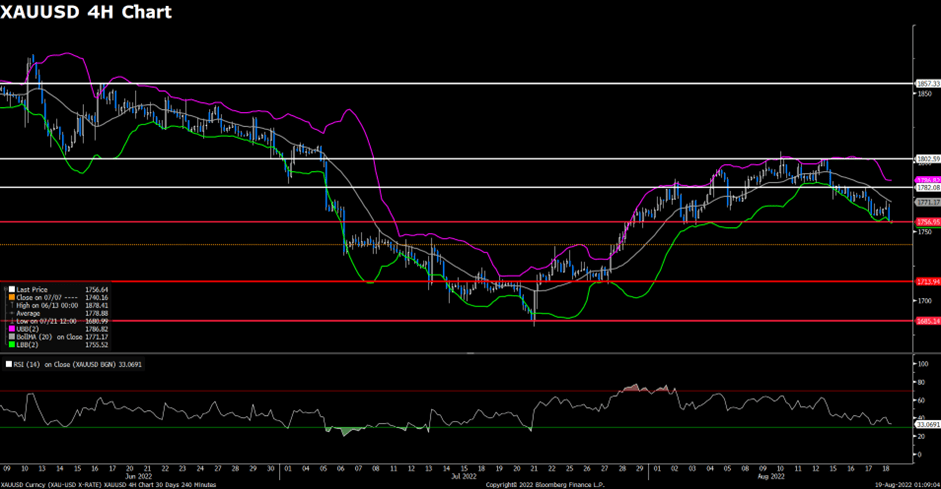

XAU/USD (4-Hour Chart)

Gold catches some upside traction on Tuesday and recovers from a multi-week low.

The price reverses an intraday dip to the $1,730 level and surges to a daily high in the US session. It seems to have snapped a six-day losing streak to a nearly four-week low and is currently placed around the $1,745 level.

Gold prices rebounded as the US dollar retreated modestly on the back of dismal August PMI figures. That said, expectations for a more hawkish message from Fed Chair Jerome Powell at the Jackson Hole symposium on Friday still support a stronger US dollar. This, along with elevated U.S. bond yields, should limit further gains on the gold price.

For the technical aspect, the RSI indicator is 47 as of writing, close to the midline, suggesting that the pair has staged a strong upside correction. As for the Bollinger Bands, the price surged and crossed above the moving average, now testing the pressure region at the $1,757 level. Besides, the moving average is still downward. In conclusion, we think the price is now right between pressure and support regions. The price might test both sides here. Investors should wait for the breakout to determine a clear direction. To the upside, the price should advance above the $1,757 level first. On the downside, if the price closes below the $1,730 level, it might head to test the next pivotal support at the $1,714 level.

Resistance: $1,757, $1,783, $1,803

Support: $1,730, $1,714, $1,685

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Core Durable Goods Orders (MoM) (Jul) | 20:30 | 0.2% |

| USD | Pending Home Sales (MoM) (Jul) | 22:00 | -4.0% |

| USD | Crude Oil Inventories | 22:30 | -0.933M |