Revised Q2 Eurozone GDP stays at +0.1% quarterly and +1.4% annually, unchanged from preliminary figures.

Fed policymakers hesitate on September rate cuts despite market pressures and uncertain data

Diverging Views

Non-voting members of the Fed, like Richmond Fed President Barkin and Atlanta Fed President Bostic, also share uncertainty. Barkin pointed out that the balance between inflation and unemployment is unclear, while Bostic mentioned that the bank prefers to wait for more data before making any policy changes. Fed governor nominee Miran downplayed the impact of tariffs on inflation as shown in CPI reports. Meanwhile, Bullard cautioned that making a large rate cut might seem “panicky.” Fed policymakers are being careful not to go against market expectations. This week, important U.S. economic data will be released, including PPI, jobless claims, and retail sales. With little time before the Jackson Hole symposium and the upcoming labor report, the Fed has few chances to influence market expectations. The FOMC blackout period starts on September 6, with a policy decision set for September 17.Market vs Fed Dynamics

Today, St. Louis Fed President Musalem and Richmond Fed President Barkin will speak, possibly offering more insights. As of August 14, 2025, there’s a noticeable gap between market hopes and Fed announcements. Fed funds futures estimate an 85% chance of a 25 basis point cut on September 17. However, officials like Schmid and Goolsbee show clear uncertainty. This difference between market belief and Fed signals often leads to volatility in the coming weeks. Market optimism is currently driven by the July CPI report, which showed inflation easing to 3.1%. However, the labor market remains strong, with the last jobs report indicating 190,000 new jobs and weekly jobless claims steady at around 225,000. This allows policymakers like Bostic to state they can “wait” for more information before taking action. For derivative traders, seeking volatility may be appealing. The VIX index is currently low at about 14, suggesting that options pricing may underestimate the potential for significant market shifts after key announcements. If the Fed decides not to change rates or cuts more than expected, it could lead to major adjustments across asset classes. The upcoming highlights to watch are the Jackson Hole symposium later this month and the jobs report on September 5. These events represent the Fed’s last chances to direct market expectations before their pre-meeting blackout begins. Any notable changes in the data could compel the Fed to take decisive action and resolve the current uncertainty. A similar situation occurred in late 2018, when the Fed adopted a cautious approach before making significant changes in early 2019 as market conditions changed. Although past events don’t repeat exactly, they indicate that ongoing market pressure can influence policy decisions. The Fed’s current hesitance may just be temporary before they align with market expectations. As a result, strategies like long straddles or strangles on major indexes, which profit from large moves in either direction, might be wise to consider ahead of the September FOMC meeting. Traders may also explore calendar spreads to capitalize on the expected volatility spike surrounding early September data. This allows traders to position themselves for the belief that current calm states won’t continue. Create your live VT Markets account and start trading now.Daly questions the need for a significant interest rate reduction next month

Steady Approach Over Quick Shift

This suggests a steady approach instead of a quick change in monetary policy. Current data does not support a significant rate cut right now. It looks like a 50 basis point cut for September is unlikely. Previously, markets, including the CME FedWatch tool, thought there was almost a 40% chance of such an aggressive move. This shows that the Federal Reserve doesn’t feel the need to take bold actions. Honestly, the economic data does not call for panic. July’s job report added a solid 195,000 jobs, keeping unemployment at 3.8%. With the latest core inflation at 2.4%, the figures don’t suggest an urgent need for action. This points to a strategy of selling volatility in the weeks ahead. A “gradual” approach signals the Fed’s plans, reducing market uncertainty and large price swings. This situation is very different from the unpredictable market fluctuations we witnessed in 2022 and 2023.Reevaluating Positions In Light Of Cautious Reality

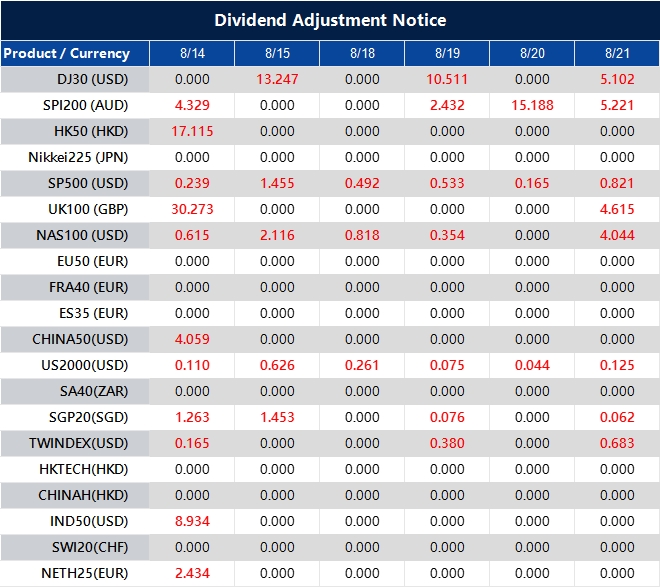

Traders should rethink positions that expected major cuts. The focus will likely move to pricing in a standard 25 basis point cut in September, or possibly a pause. We can expect changes in Fed Funds futures and options on SOFR to reflect this more cautious outlook. For equity options, this perspective makes a strong case for limited upside moves due to aggressive easing. Strategies that work well in a steady, mild market rather than a volatile one are more suitable now. We believe a slow and steady policy path offers a solid foundation for the market. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 14 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].