(In comparison to other markets)

The forex market is the world’s largest, and it offers numerous advantages that attract traders. The following are some of the primary reasons to give forex trading a try.

Unparalleled liquidity

The foreign exchange market is highly liquid, which is another way of saying that other traders are always available to engage. However, why is liquidity so critical?

Assume you’re attempting to sell a Nokia phone manufactured in 2000. If you placed an ad on eBay asking for $1,000, you’re unlikely to receive an offer — and if you do, it’s likely to be for a few hundred dollars (at most) a month later. Essentially, there aren’t many buyers and vendors for that goods.

However, if you were to sell the current iPhone at the price you purchased, you would almost certainly receive multiple offers, most of which would be close to your asking price. This is simply due to the market’s high volume of buyers and sellers. This is a technique for proving enough liquidity.

Volatility

Another reason it is pretty popular is due to the volatility of the FX market. This is related to currency fluctuations, which are determined by the real economy of various countries. Because economic outlooks are constantly changing – due to factors such as recent news and events – the accompanying currency’s value will fluctuate. These movements provide traders with an opportunity to benefit from forex deals.

24-5

The currency market is open twenty-four hours a day, five days a week. This 24-hour trading provides traders in various world regions with numerous changes, depending on which markets are available at particular times. For instance, when trading sessions overlap – as they do during the few hours that the US and European markets are open concurrently – there can be more trading activity, resulting in new chances. The markets’ 24/5 nature also provides traders with flexibility – for example, even if you’re locked in the office all day, you may still conduct a few trades over lunch or while relaxing at home in the evening.

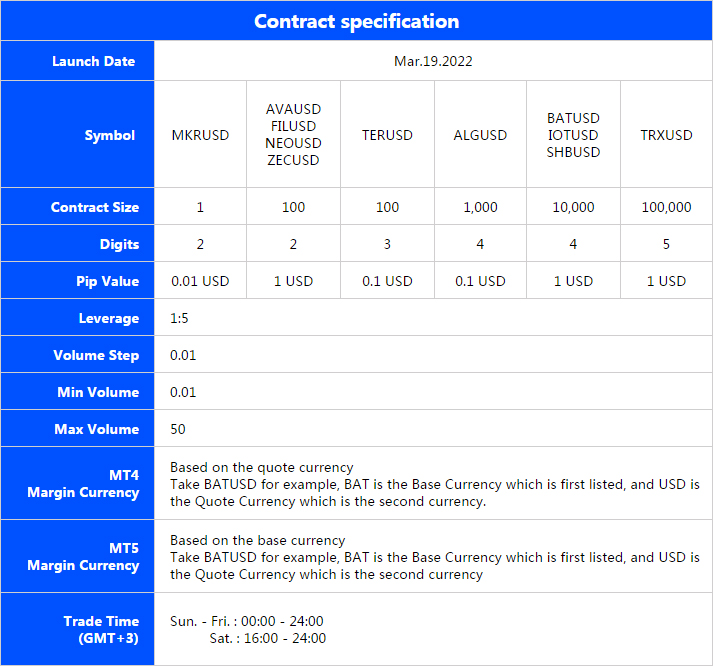

Trading with leverage

One of the beautiful aspects of forex is that it allows for leveraged trading. This indicates that you can use a small amount of capital to undertake a higher-value trade. In effect, leveraged trading will enable you to stretch your money further.

For instance, leverage of 1:100 means that a $1 investment may purchase $100 worth of “forex.” While leverage has the potential to help you earn more money more rapidly, it also has the potential to cause you to lose more money. Therefore, whenever you trade with leverage, proceed with prudence and trade only what you can afford to lose.