There are several ways to trade Forex, and each method has its own advantages and disadvantages.

The most popular financial instruments used in Forex trading include retail Forex, spot FX, currency futures, currency options, currency exchange-traded funds (or ETFs), Forex CFDs, and Forex spread betting.

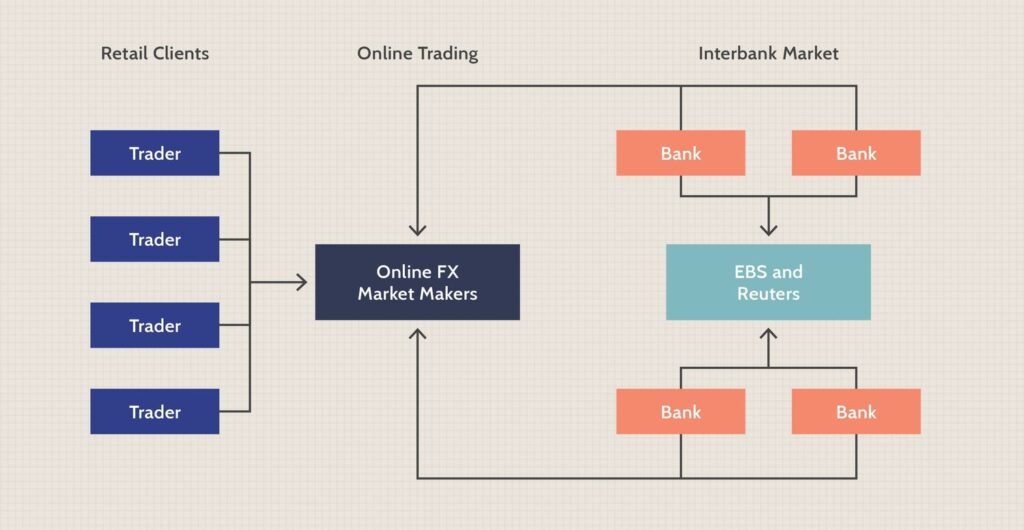

Retail Forex is a way for individuals to participate in the Forex market through Forex trading providers or brokers. These brokers trade on behalf of the retail traders in the primary OTC market by finding the best prices and adding a markup before displaying them on their trading platforms. Retail Forex trading involves trading contracts to deliver underlying currency rather than the currency itself.

Retail Forex trading is leveraged, meaning traders can control large amounts of currency with a small initial required margin. For example, with $2,000, traders can open a position valued at $100,000. However, this also means that traders can potentially lose more than their initial investment.

To avoid the physical delivery of currency, retail Forex brokers automatically “roll” client positions by entering into an equal but opposite transaction. This rolling process is known as Tomorrow-Next or “Tom-Next” and results in either interest being paid or earned by the trader, known as a swap or rollover fee.

Retail Forex trading is considered speculative, as traders are trying to profit from the movement of exchange rates without taking physical possession of the currencies they buy or sell. It is important for traders to understand the risks involved and to have a solid understanding of the market before participating in retail Forex trading.

Spot FX is an OTC market where customers trade directly with a counterparty. Unlike centralised markets, spot FX contracts are private agreements between two parties, and most trading is done through electronic trading networks or by telephone.

The primary market for FX is the interdealer market, which is dominated by banks and accessible only to institutions that trade in large quantities.

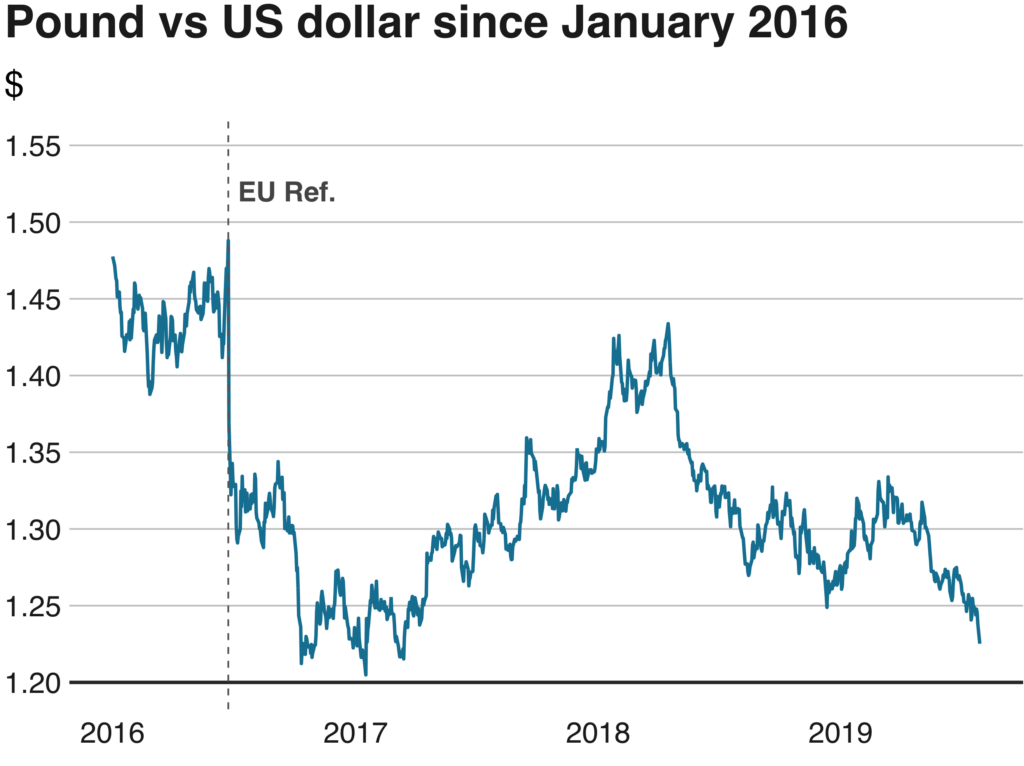

In the spot FX market, traders buy or sell contracts to make or take delivery of a currency at the current exchange rate. The price of currencies in the spot market is determined by several factors, such as current interest rates, economic performance, geopolitical sentiment, and price speculation.

The finalisation of a deal in the spot market is known as a spot deal, which is a bilateral transaction between two parties. A position in the spot market is settled in cash, but it takes two business days for the actual transaction to be settled.

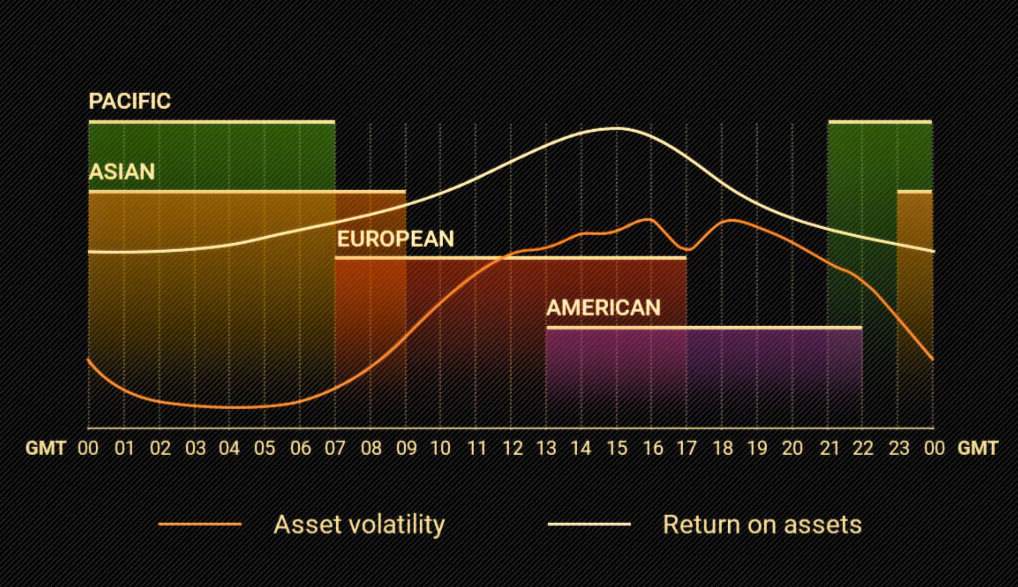

Although the spot FX market operates 24 hours a day, it is not where retail traders trade.

Currency futures are contracts that allow traders to buy or sell a certain amount of currency at a set price and date in the future.

They were introduced in 1972 by the Chicago Mercantile Exchange (CME) and are traded on centralised exchanges.

The contracts have standard details, such as the amount of currency, the date when the trade will happen, and the smallest price change allowed. The exchange makes sure that both sides of the trade are settled. Traders can buy or sell currency futures based on a fixed size and date at commodities markets.

The market is well-regulated, and you can easily get information about prices and trades. Currency futures are used by traders to protect against currency value changes or to predict future changes.

Currency options are financial agreements that give the holder the right, but not the obligation, to buy or sell a specific amount of currency at a fixed exchange rate or before a future date.

These options are available for trading on popular exchanges such as the Chicago Mercantile Exchange (CME), the International Securities Exchange (ISE), and the Philadelphia Stock Exchange (PHLX).

In general, currency options are commonly used to protect against unfavourable changes in exchange rates by corporations, individuals, and financial institutions. At the same time, traders can use currency options to speculate on currency movements.

Currency ETFs are managed investments in one or multiple currencies. They are created and managed by a financial institution and traded like a stock.

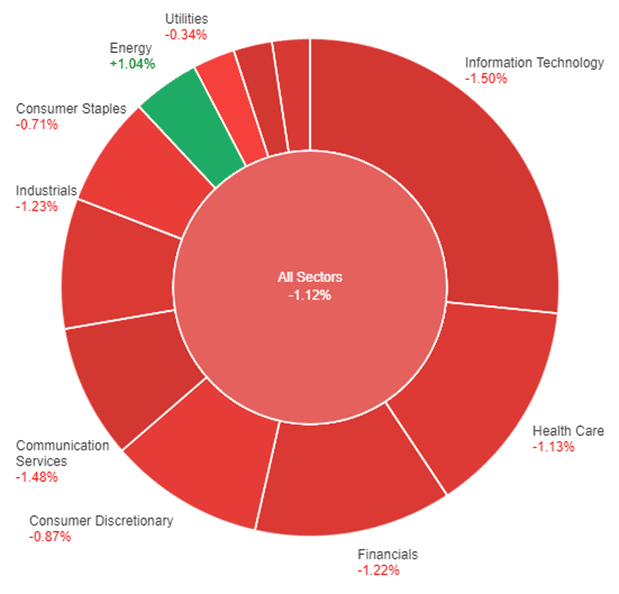

Currency ETFs serve various purposes: speculation, diversification, and hedging. But they come with macroeconomic risks like geopolitical risks and interest rate hikes.

Despite the limitations of trading, currency ETFs offer a convenient way to invest in the Forex market without the burden of managing investments.

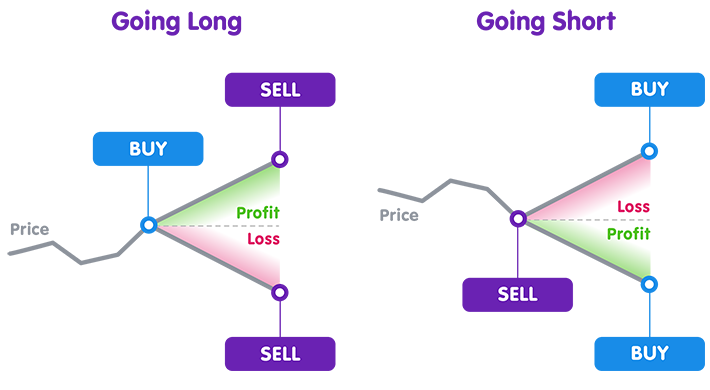

Forex CFDs, also known as Contracts for Difference, are financial instruments that allow traders to speculate on whether the price of an underlying asset, like a currency pair, will rise or fall. When a trader enters into a CFD contract, they agree with a provider to exchange the difference in the value of the asset between the opening and closing of the trade.

Unlike traditional investments, CFD investors don’t actually own the underlying asset; instead, they receive revenue based on the price change of that asset.

The advantages of trading Forex CFDs include access to the underlying asset at a lower cost than buying it outright, ease of execution, and the ability to take both long and short positions.

Forex spread betting is a way to predict if a currency’s price will go up or down in the future without owning it. The price is based on the currency’s value in the FX market.

Spread betting providers allow this type of trading and consider three factors: the trade direction, the bet size, and the spread of the instrument traded.

One benefit of forex spread betting is that traders can use leverage to potentially make a larger profit from a smaller investment. However, if the market moves against you, you could lose more than your initial investment.

Each of these trading methods has its advantages and disadvantages, and traders should choose the method that best suits their trading style and risk tolerance.

Summary

- Forex trading has several methods, including retail Forex, spot FX, currency futures, currency options, currency ETFs, Forex CFDs, and Forex spread betting.

- Retail Forex is for individuals to participate in the Forex market through brokers who trade on behalf of retail traders.

- Spot FX is an OTC market where customers trade directly with a counterparty.

- Currency futures are contracts that allow traders to buy or sell a specific currency at a future date and a fixed price.

- Currency options are financial agreements that give the holder the right, but not the obligation, to buy or sell a specific amount of currency at a fixed exchange rate or before a future date.

- Currency ETFs are managed investments in one or multiple currencies.

- Forex CFDs allow traders to speculate on whether the price of an underlying asset, like a currency pair, will rise or fall.

- Forex spread betting is a form of betting where the trader bets on the movement of a currency pair.