France’s July preliminary CPI meets expectations, raising concerns about services price inflation and its impact on ECB outlook

Ueda highlights the benefits of the US-Japan trade deal as Japan’s economy shows moderate recovery amid uncertainties

US-Japan Trade Deal Progress

The US-Japan trade deal represents progress and reduces uncertainty about the economic forecast. This suggests there may be future interest rate hikes, although the Bank of Japan is unlikely to commit to this immediately. Recent comments show a shift in the Bank of Japan’s thinking. Revised inflation forecasts indicate they may raise rates sooner than expected, signaling a move away from the very easy policies of the post-pandemic period. Data supports this shift. The national core-core CPI for June 2025 was 2.3%, staying above the 2% target for the fourth month in a row. This ongoing price pressure, along with average wage increases of 4.5% from spring Shunto negotiations, gives the Bank of Japan a solid reason to take action.Implications for Currency and Bond Markets

For traders, this points to a stronger yen in the coming weeks. After the USD/JPY rate approached 170 earlier this year, these new comments could lead to a significant reversal. It’s wise to prepare for a move back toward the 160-162 range using options or futures. We must keep a close eye on the Japanese Government Bond market. Since the end of Yield Curve Control in early 2024, the 10-year JGB yield has risen to about 1.1%. Another rate hike could push this closer to 1.25%, opening up opportunities in interest rate swaps and bond futures. The new US-Japan trade agreement is a key factor in this situation. By lowering tariffs and reducing economic uncertainty, it removes a major reason the Bank of Japan has had for not acting over the past year. This makes a policy change more likely than at any time since the last small hike. Create your live VT Markets account and start trading now.Retail sales in Switzerland increase by 3.8%, exceeding the expected 0.2% rise

Global Economic Effects

US tariffs on goods like copper are affecting prices worldwide, and India is facing a 25% tariff. Changes in UK tax laws are impacting wealthy individuals, leading to a 14% drop in butler jobs. Due to US tariffs, India’s rupee has hit a five-month low, which is impacting market expectations. In technology news, OpenAI’s revenues have skyrocketed thanks to an influx of ChatGPT users. Microsoft and Meta have also reported strong earnings, with Meta planning major investments in superintelligence technologies. Additionally, there’s a warning about the risks of foreign exchange trading. The ongoing US-Iran conflict signals high geopolitical risk, indicating a need for long volatility strategies. Buying VIX call options or options on major indices might be a wise hedge. Historical data shows that spikes in Middle Eastern tensions, like in early 2020, caused the VIX to jump over 30% in a week; we might see this pattern again.Federal Reserve Stance

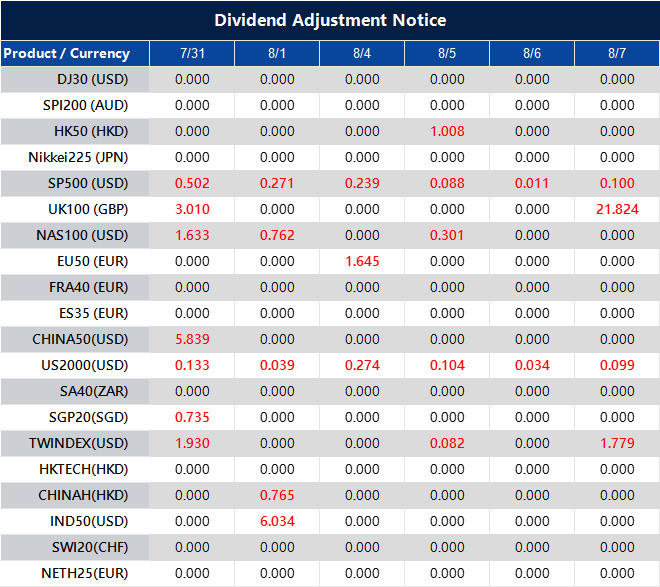

The Federal Reserve is keeping its rates at 4.3%, which clashes with political calls for deeper cuts. This situation suggests opportunities for trading interest rate volatility through options on Fed Funds futures or SOFR futures. After the Fed’s latest statement, the chances of a rate cut in September have likely dropped below 20%. However, if Powell shows any uncertainty, it could lead to sudden market shifts. Switzerland’s retail sales have exceeded expectations with an impressive 3.8% annual growth instead of the anticipated 0.2%. This robust economic performance strengthens the case for the Swiss franc, particularly against weaker currencies. We might consider call options on CHF or short EUR/CHF futures, anticipating more strength ahead. High tariffs have significantly impacted copper prices, which have fallen by 50%, affecting industrial and emerging markets. Continued pressure makes put options on copper miners or shorting copper futures attractive. The new 25% tariff on India will likely further weaken its industrial demand, adding to the bearish outlook. We’re seeing a clear divide in the market: Big Tech is thriving, while the broader economy is under stress. Strong earnings from Microsoft and Meta and hefty revenue growth for OpenAI indicate that technology could be a safe haven amid uncertainty. This separation opens up a pair trade opportunity: going long on the Nasdaq 100 via futures while buying puts on more industrial-focused indices like the Russell 2000. India is certainly feeling the impact of US tariffs, with the rupee at a five-month low and a decline in the Nifty index. The grim growth outlook and a recent Reserve Bank of India report showing a 1.2% drop in manufacturing PMI might lead traders to consider buying USD/INR call options, betting on further rupee weakness toward the 88.00 level. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 31 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].