Do you regularly see social media influencers sharing financial and investment tips? These influencers are masterful at capturing their viewers’ attention by making hundreds of dollars in profits within minutes!

Upon a closer look, these individuals are experienced forex and gold traders. In other words, they actively trade CFDs as a source of income.

Yes, terms like forex and gold are familiar, but what exactly is CFD trading?

What is CFD Trading?

CFD trading involves speculating the rise or fall of a financial asset’s price. You profit or lose based on predicting the asset’s price movement. Examples of financial assets in CFD trading are currency pairs, gold, Bitcoin, and indices.

CFD stands for ‘Contract for Difference.’ The contract refers to an agreement between a trader and a broker to pay the price difference of an underlying asset. This difference is calculated from when the contract is opened until it’s closed.

CFD trading allows traders to trade financial assets without owning them. This is what price speculation in CFD trading is all about.

Do you need a simple analogy to understand CFD trading?

Let’s say you and a friend are clashing over Bitcoin’s price direction in 15 minutes. You predict it will rise, while your friend says it will slide.

Both of you wager RM100 each. If Bitcoin’s price rises, your friend pays you the price difference, and vice versa if it falls.

After 15 minutes, Bitcoin’s price increases by RM10. You gain RM10, which brings your total to RM110, while your friend loses RM10, leaving her with RM90.

In this scenario, neither of you owns Bitcoin, but both transact based on price speculation.

This is the simplified definition of CFD trading.

What Do You Need to Start CFD Trading?

1. Capital

Good news for beginners: CFD trading doesn’t require large initial capital. With VT Markets, you can own a live trading account with a minimum deposit of $50.

2. Broker Account

Open an account with a CFD broker. (Refer to point 1 above!)

3. MetaTrader 4/5 Platform

This charting platform lets you analyse markets, select assets, choose lot sizes, and execute trades. Available as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

4. Trading Plan

This plan outlines your strategy: Will you trade hourly, daily, or within minutes? How much risk can you tolerate per trade? A trading plan guides you to trade safely and effectively.

5. Discipline and Resilience

Mental strength is crucial in CFD trading. While you can earn hundreds in minutes, the next trade could wipe out profits just as fast. Managing your psychology is key to long-term success.

6. Basic CFD Trading Knowledge

Understand the financial assets you trade. Learn technical and fundamental analysis. Technical skills help with interpreting charts and spotting opportunities, while fundamentals explain market sentiment via economic and geopolitical news.

Financial Assets in CFD Trading

Forex

Traded as currency pairs (e.g., EURUSD), where traders buy or sell one currency against another.

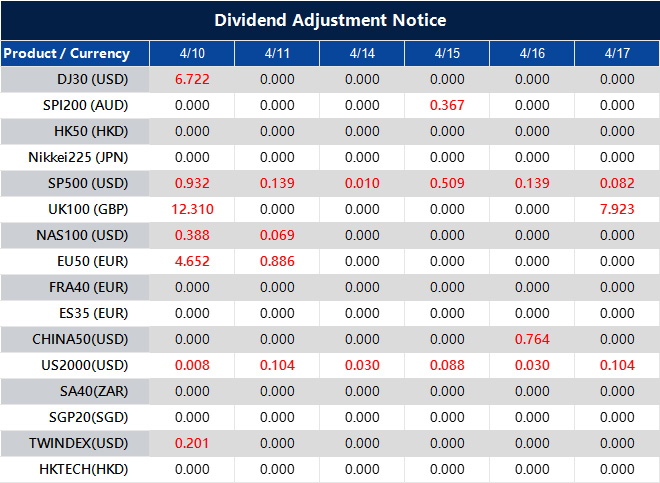

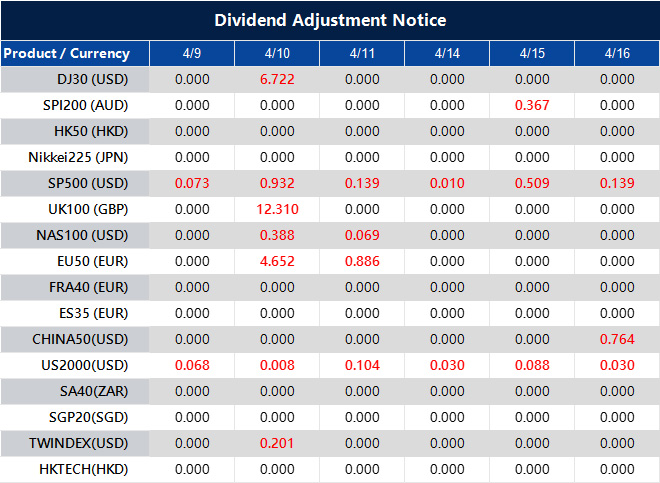

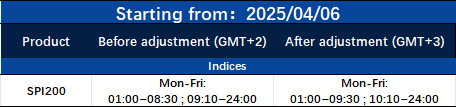

Indices

Represent groups of stocks measuring market or sector performance (eg S&P 500).

Energy

Trade assets like crude oil, leveraging dynamic price movements in energy markets.

Precious Metals

Gold, silver, platinum, and palladium are safe-haven assets during economic turbulence.

Soft Commodities

Unlike precious metals, which are acquired from mining activities, agricultural products like cocoa, coffee, cotton, and sugar are harvested from farms.

ETFs

Track indices or sectors, exposing traders to stocks/bonds without direct ownership.

Share CFDs

Profit from share price movements without owning them. Unlike traditional share trading, trading CFD shares allows you to profit from a bear market.

Bond CFDs

Governments and firms can raise their capital by securing bonds from investors. Bond trading through CFD offers a systematic way to speculate on this instrument’s price movements.

Advantages and Risks of CFD Trading

Advantages

1. Leverage and Small Capital

Got $100 but want to trade $1,000? That’s where leverage comes in. It boosts your lot size with a small capital.

2. Access to Global Markets

CFD trading isn’t limited to forex. You can also trade gold, silver, oil, stocks, and indices from one broker account.

3. No Asset Ownership Needed

Want to trade oil? With CFDs, you don’t need to buy physical barrels. Remember, CFD trading is about price movement, not ownership.

4. Two-Way Opportunity

Traders can open buy or sell positions, profiting in a rising or falling market.

Risks

1. Market Volatility

Asset prices can change rapidly, causing significant fluctuations in short periods.

2. Economic News

You need to be attuned to global economic and geopolitical news. Markets can swing in the blink of an eye based on new developments.

3. Leverage

It’s a double-edged sword. While leverage increases your exposure, it can also magnify your losses if the market moves against you.

How to Trade CFDs

For simplicity, this section focuses on trading with MetaTrader 4.

A reminder – you must register with a broker before logging into MT4.

As a beginner, you can duplicate the steps below with a demo account. A demo account allows you to simulate trading in actual market conditions.

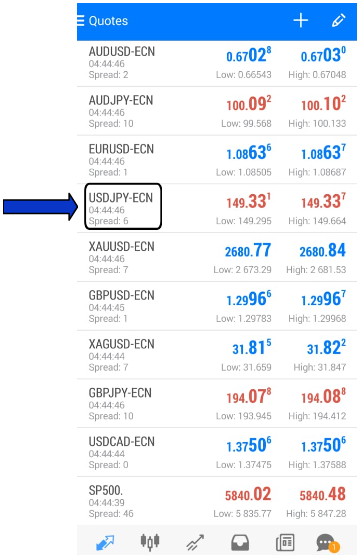

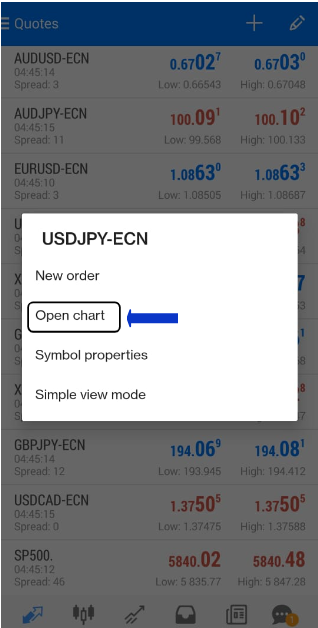

1. Choose the asset you want to trade. Let’s say you want to sell USDJPY.

2. Click ‘Open chart’.

3. Change the timeframe accordingly by tapping on the chart. M1, M5, M15 and M30 produce a single candlestick in 1, 5, 15 and 30 minutes, respectively. H1 and H4 give you an hour and 4-hour candlestick. D1 gives you a day candlestick, W1 a week candlestick, and MN consolidates a month’s worth of candlesticks.

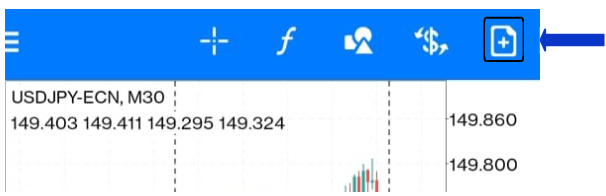

4. Click the ‘+’ icon to open a Buy or Sell position.

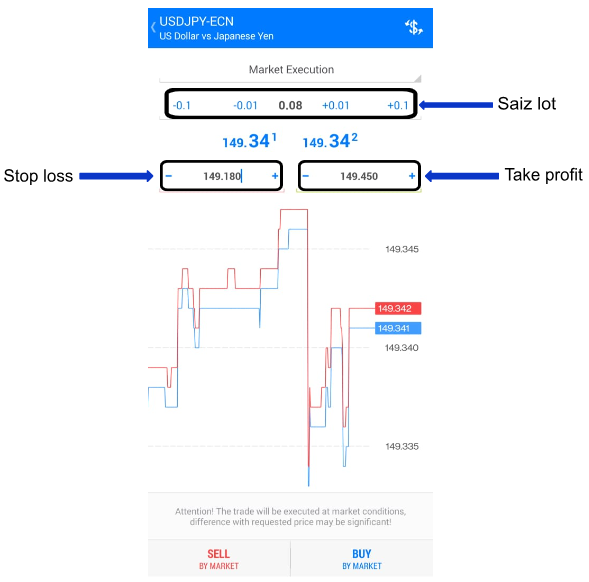

5. Set your Stop Loss and Take Profit. Stop Loss protects you from further losses. Take Profit sets your target to exit and lock in profits.

Then, choose your lot size based on your capital: Standard lot (1.0), Mini lot (0.1), Micro lot (0.01) and Nano lot (0.001). The bigger your capital, the bigger the lot size that you can pick.

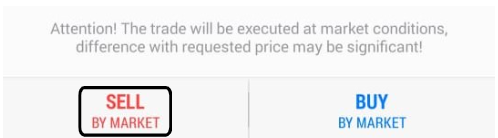

6. Finally, click ‘Sell’ to place your trade!

That’s all; we have covered the basic steps for trading on MetaTrader 4.

In actual trading, you’ll need to analyse the market before picking a position. This is where your trading plan helps before clicking ‘Buy’ or ‘Sell’.

How to Choose a Trusted CFD Broker

A CFD broker provides financial services and access to CFD markets. Here’s what to consider when choosing a reliable one:

1. Regulatory Compliance

In CFD trading, you’ll frequently deposit and withdraw money. So, your broker must be regulated to ensure fund safety.

A trusted broker should hold relevant licenses and be regulated by reputable authorities in the financial industry to ensure your fund’s security. Reputable regulators include:

– Financial Sector Conduct Authority

– Australian Securities & Investment Commission

– Financial Services Commission, Mauritius

2. Fund Insurance

Let’s touch wood. What happens if the broker goes bankrupt? You want assurance that your funds are safe.

Worry not! There are responsible brokers offering insurance protection if they have to foreclose.

Here’s one of the responsible brokers – VT Markets offers fund protection of up to $1,000,000 in the unlikely event of VT Market’s foreclosure.

Even though the odds of this mishap are like a speckle of dust, this scheme by VT Markets underlines its commitment to secure clients’ funds and reinforce its reputation as a trusted CFD trading broker.

3. Fast Deposits & Withdrawals

Ensure you can deposit and withdraw from the broker account within the same day.

4. Deep Liquidity

Liquidity determines how easily an asset can be traded. Check the spread. A lower spread means higher liquidity.

For example, VT Markets offers spreads as low as 0.0 pips.

5. Various Account Types

From Standard STP to ECN, Cent, and swap-free accounts, brokers should offer options to suit your trading style.

6. Multiple Deposit & Withdrawal Methods

The more options, the easier it is to manage your funds.

7. Wide Trading Assets

Diversification helps reduce risk. Look for brokers offering forex, gold, oil, commodities, crypto, ETFs, and stocks.

8. Education

Brokers that offer trading education through blogs, videos, webinars, and seminars show they care about your success.

9. Customer Support

Make sure the broker offers 24/7 support and easy access to their service team.

Are You Ready To Trade CFD?

Now you understand what CFD trading is, its requirements, available assets, advantages and risks, how to use MetaTrader 4, and how to pick a reliable broker.

If you’re ready to take the first step, why not open a live account with us?

You just need a minimum of $50 to own a VT Markets trading account.