China’s Commerce Ministry has expressed strong opposition to the United States implementing a 10% tariff on Chinese imports effective from March 4.

The ministry plans to take necessary countermeasures to protect China’s legitimate rights and interests, asserting that the US has ignored facts and international trade rules.

The spokesperson labelled the US actions as a clear example of unilateralism and coercion.

Rising Trade Tensions

This direct rebuke from Beijing underscores the rising friction between the world’s two largest economies. When tariffs like these are introduced, they rarely exist in isolation. Retaliatory measures tend to follow, and that can introduce fresh concerns across financial markets.

Washington’s decision to impose additional duties on Chinese goods affects more than just diplomatic relations. Supply chains feel the weight of higher costs, businesses reconsider sourcing strategies, and price pressures may filter down to consumers. Policymakers in Beijing will not let such a move pass without response. If past patterns hold, countermeasures will likely mirror the approach taken in prior disputes—perhaps through targeted tariffs on US exports or stricter regulatory scrutiny on American firms operating within China.

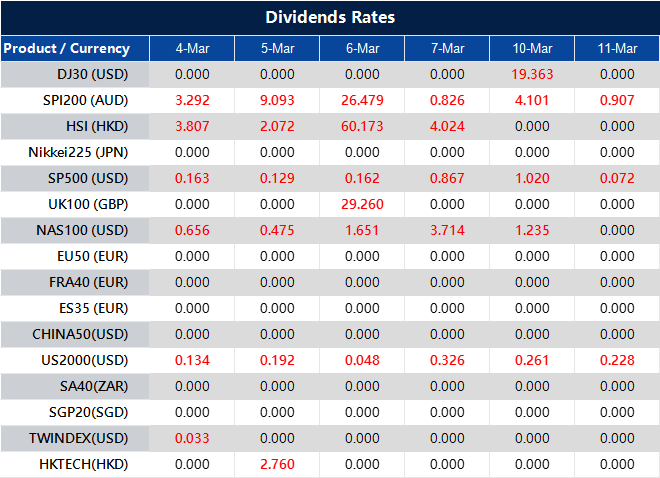

From an economic standpoint, these latest developments add another layer of complexity to an already fragile global trade climate. Traders should consider how Beijing’s reaction could affect multiple asset classes. When major economies engage in such disputes, equities, currencies, and commodities tend to reflect the uncertainty. Previous tariff escalations have had clear effects on market sentiment. Sudden shifts in risk appetite have led to increased volatility, and that may repeat in the weeks ahead.

Currency markets, in particular, could see sharp moves. In past confrontations of this nature, the yuan has often come under pressure. Authorities in Beijing manage the currency closely, but prolonged trade disputes have previously led to depreciation trends. If that pattern resumes, related assets may experience follow-through effects. Similarly, adjustments in capital flows could impact broader liquidity conditions.

Equities tied to trade-sensitive sectors should not be overlooked either. Manufacturing, technology, and consumer goods tend to be at the forefront during such tensions. If fresh tariffs push production costs higher, earnings forecasts may need recalibration. That recalibration can fuel further market adjustments, particularly in companies with considerable exposure to US-China trade.

Beijing’s Strategic Response

The stance taken by Beijing leaves little ambiguity. Officials have framed this as a direct challenge to fair trade principles. If the past serves as any indication, the next steps may not be limited to matching tariffs alone. Broader policy tools remain at their disposal, whether through adjustments in import policies, regulatory pressures, or incentives aimed at reducing reliance on US goods.

Historical precedents should guide expectations. The last time tariffs were raised at this level, markets moved swiftly, and uncertainty deepened before any resolution emerged. Those with exposure to affected sectors should reassess positioning with that in mind. Reaction time matters in environments like this, particularly when policy decisions can come with little warning.

As Beijing prepares its response, ripple effects may extend well beyond direct trade channels. The interconnected nature of modern global markets means that decisions taken in one capital are rarely contained there. Investors must weigh not just the immediate tariff impact, but also how expectations of prolonged tensions could shape broader positioning. Until there is clarity on countermeasures, reactive market movements could become more frequent.

The coming weeks will offer more concrete signals of Beijing’s strategy. If prior disputes are any guide, announcements may arrive abruptly. Policymakers have little incentive to telegraph their full response in advance. Those watching developments should prepare for rapid shifts, particularly in asset classes sensitive to trade policy news.

Trade frictions of this scale have rarely been resolved quickly, and this time appears no different. With retaliatory steps on the horizon, near-term adjustments in supply chains and financial markets should not be dismissed. Reaction speed, adaptability, and thorough monitoring will be essential.

Create your live VT Markets account and start trading now.