Stocks took a breather after a robust four-week surge as major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, dipped slightly. Cyber Monday witnessed rises in e-commerce stocks like Amazon and Shopify while “buy now, pay later” options surged, propelling Affirm’s stock. However, concerns over weakening consumer spending raised Fed rate hike impact worries. The currency market saw the US Dollar Index dip, reflecting vulnerability amidst declining Treasury yields. Economic indicators, including new home sales, shaped concerns, while currency movements, especially the EUR/USD climb, GBP/USD trajectory, and AUD/USD surge, drew attention. Gold and silver rallied, breaching significant resistance levels.

Stock Market Updates

Stocks took a breather on Monday following a robust four-week surge across major averages. The Dow Jones Industrial Average dipped by 0.16%, closing at 35,333.47, while the S&P 500 shed 0.20% to settle at 4,550.43, and the Nasdaq Composite edged down 0.07% to 14,241.02. The recent bullish trend stemmed from a retreat in the 10-year Treasury yield from briefly surpassing the 5% mark in late October. Despite concerns over weakening consumer spending from some retailers, the market maintained momentum, evidenced by a significant month-to-date increase in the S&P 500 by 8.5%, the Dow by 6.9%, and the Nasdaq by 10.8%.

Amidst the market fluctuation, Cyber Monday saw notable rises in certain e-commerce stocks, with Amazon and Shopify marking increases of 0.7% and 4.9%, respectively. The surge in interest in “buy now, pay later” options on Cyber Monday saw Affirm’s stock soar by nearly 12%. However, weaker spending data is seen as a potential indication that the Federal Reserve’s rate hikes might be impacting the broader economy, raising questions about consumer confidence. Looking ahead, key reports like the consumer confidence report and the personal consumption expenditures price index are expected to provide further insights into the market’s trajectory. Additionally, recent data from the Commerce Department revealed a slower-than-expected pace of new home sales in October, although there was an improvement from the previous year.

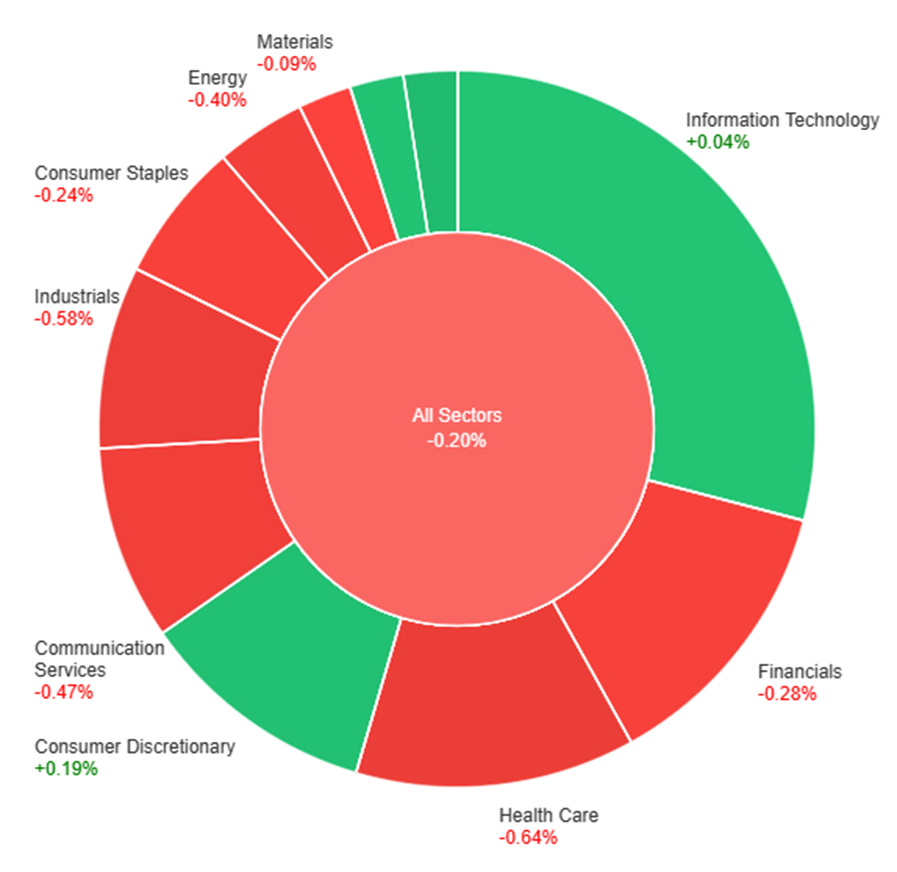

Data by Bloomberg

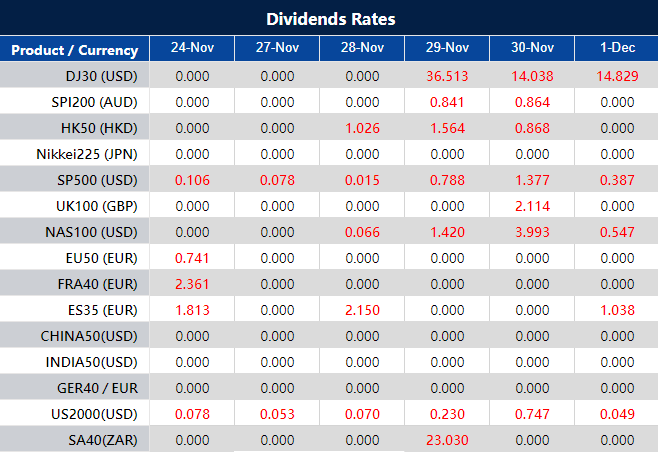

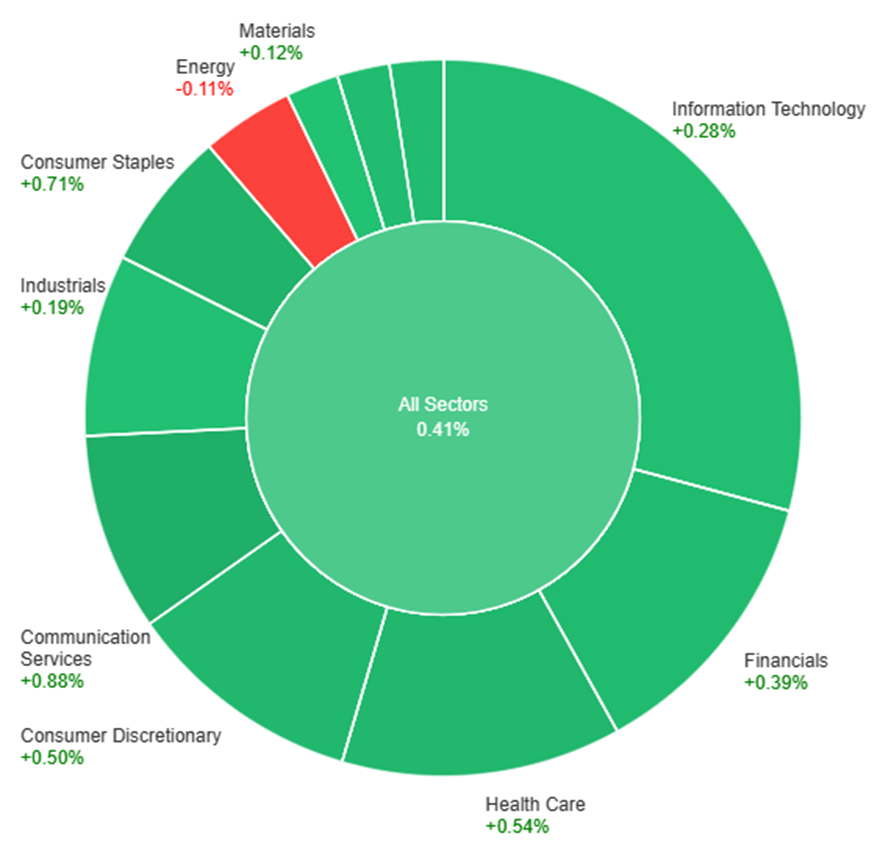

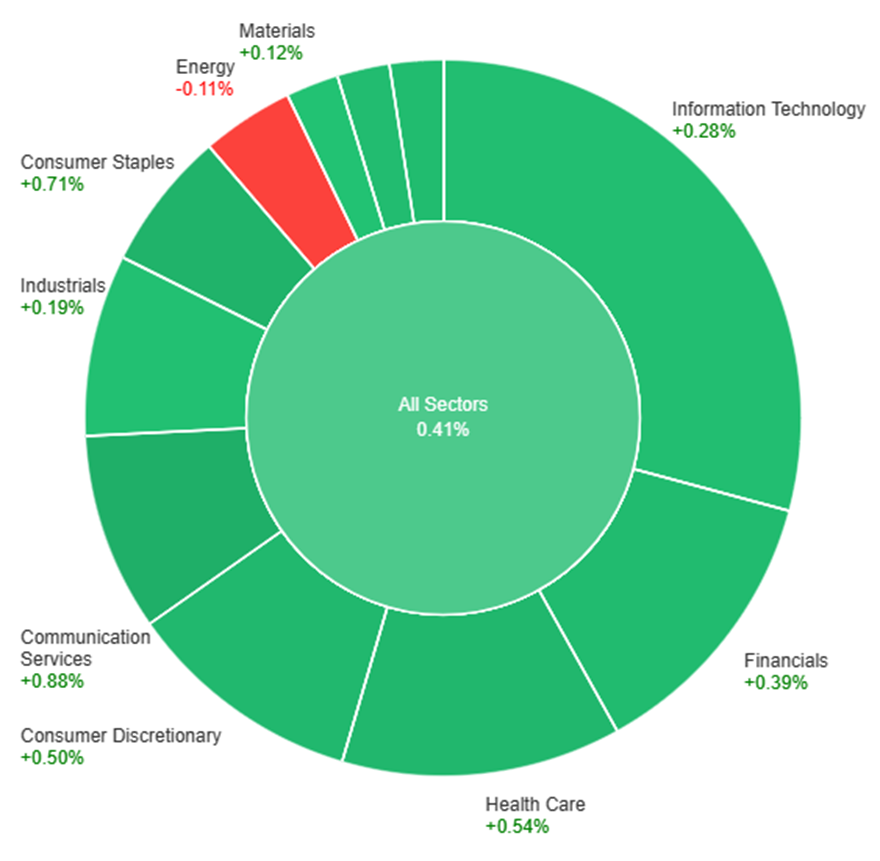

On Monday, the market saw a general decline with the overall sectors showing a negative trend of -0.20%. Real Estate and Consumer Discretionary sectors were the only ones to experience positive growth, gaining +0.38% and +0.19% respectively. Utilities and Information Technology followed with marginal increases of +0.09% and +0.04%. However, the majority of sectors faced losses, notably in Health Care (-0.64%), Industrials (-0.58%), Communication Services (-0.47%), and Energy (-0.40%). Financials and Consumer Staples also experienced declines at -0.28% and -0.24% respectively, while Materials showed a minor dip of -0.09%. Overall, it was a day marked by widespread negative performance across sectors, despite some minor gains in select areas.

Currency Market Updates

In the recent currency market updates, the US Dollar Index experienced a 0.20% dip, marking its lowest daily closure since late August, settling near 103.20. This downward trend persists, indicating the Greenback’s vulnerability, accentuated by declining Treasury yields—specifically, the 2-year fell to 4.89% and the 10-year decreased from 4.50% to 4.38%. The US New Home Sales declined unexpectedly by 5.6%, hitting 679K, below the anticipated 725K mark. This week’s US data focuses on housing metrics, consumer confidence, and manufacturing indices, culminating in the Core Personal Consumption Expenditure Index. Federal Reserve officials are slated to speak, with a blackout period commencing shortly.

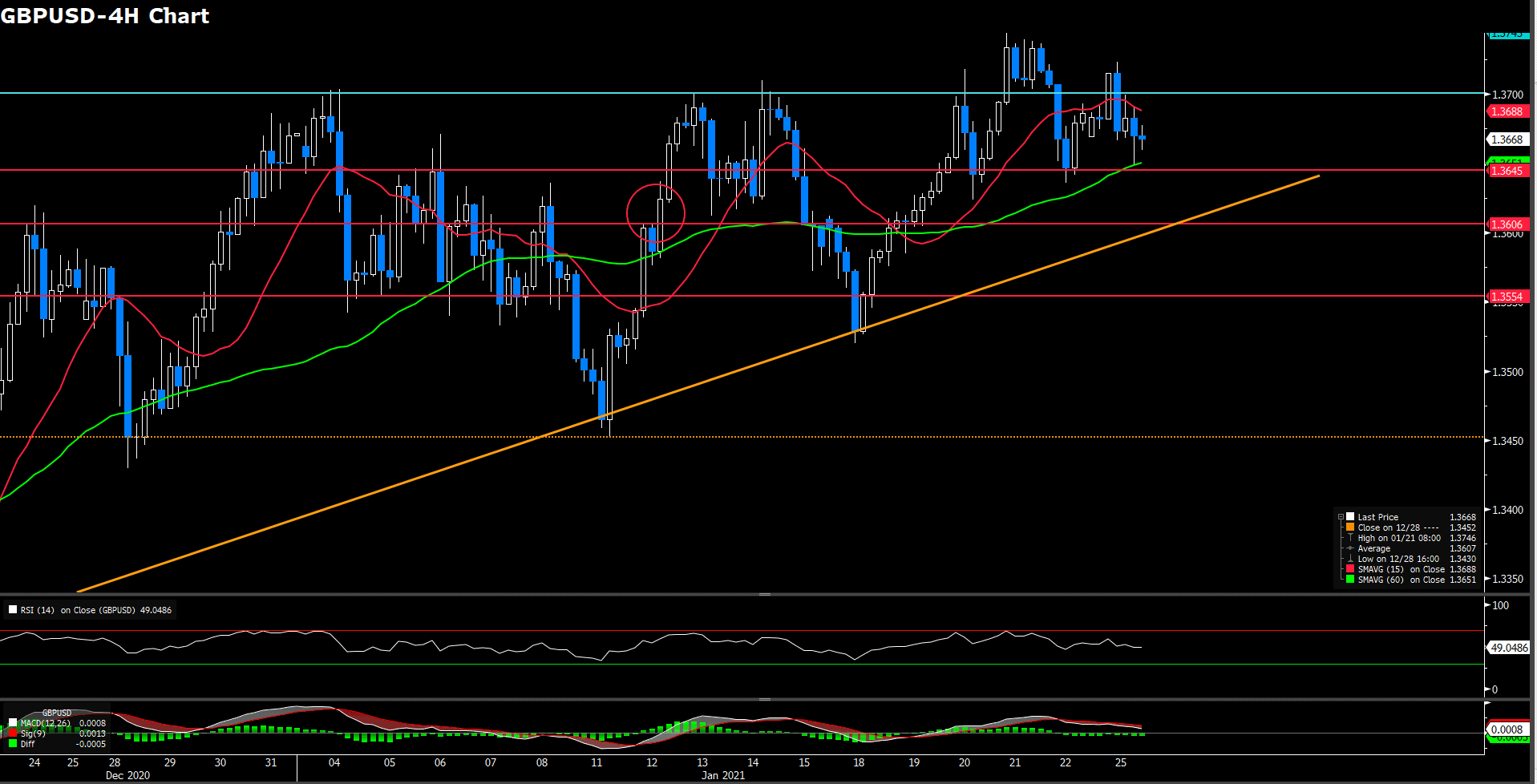

Amidst this, the EUR/USD climbed to a three-month high, maintaining the potential for further growth while above 1.0950, eyeing a probable test of 1.1000. Attention in Europe hones in on upcoming inflation figures and the German GfK survey. Meanwhile, GBP/USD continued its upward trajectory, surpassing 1.2600, steering towards establishing a fresh equilibrium level. However, USD/JPY witnessed a decline, descending to around 148.50, impacted by diminished yields after a period of subdued trading.

Elsewhere, AUD/USD surged above 0.6600, marking its peak since early August and surpassing the 200-day Simple Moving Average (SMA). The Reserve Bank of Australia’s Governor Bullock is scheduled for a discussion on economic aspects, coinciding with the release of October Retail Sales data. USD/CAD stayed below the 55-day SMA, potentially aiming for the 1.3600 zone, with a downside bias ahead of the impending employment data.

Complementing these currency movements, gold and silver rallied significantly, breaching significant resistance levels—gold surged past $2,010, while silver recorded its highest daily closure above $24.50 in weeks.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Climbs to Three-Month High Amid Dollar Strain and ECB Caution

The EUR/USD marked a significant upswing, reaching its highest point in three months, propelled by a weakening US Dollar and a persistent bullish trend. With the Greenback facing continued pressure due to subdued Treasury yields, ECB President Christine Lagarde’s warnings about potential inflation upticks and tepid growth added to the Dollar’s woes. Despite disappointing US New Home Sales data and impending housing figures, the Dollar’s strain persisted, allowing the EUR/USD to soar. Nevertheless, market attention is poised to shift toward contrasting growth trajectories between the US and the Eurozone, posing a potential impact on the current bullish momentum.

On Monday, the EUR/USD moved slightly higher, attempting to reach the upper band of the Bollinger Bands. Currently, the price is hovering just below the upper band, showing potential for consolidation and a possible move toward the middle band. The Relative Strength Index (RSI) remains at 63, indicating a neutral position for the currency pair.

Resistance: 1.0965, 1.1004

Support: 1.0925, 1.0885

XAU/USD (4 Hours)

XAU/USD Soars to $2,016 Amid Dollar Weakness: Fed Speculation and Market Mood Swings Drive Precious Metal’s Rally

Gold, represented by XAU/USD, surged to $2,016.38 an ounce propelled by broad US Dollar weakness in the initial half of the day, only to taper to $2,010 as Wall Street’s opening prompted a mild dollar rebound. The Greenback’s recovery stemmed from market sentiment shifts and waning near-term seller interest, fueled by speculation that the Federal Reserve has concluded its tightening cycle. Despite intraday stock market declines, the Dollar struggles to sustain a lasting recovery. In the absence of major economic events, the focus shifts to forthcoming inflation updates from Germany, the Eurozone, and the US, particularly the Fed’s favored inflation gauge, the October Personal Consumption Expenditures (PCE) – Price Index, anticipated next Thursday.

On Monday, the XAU/USD moved slightly higher and managed to reach the upper band of the Bollinger Bands. Currently, the price is just below the upper band, indicating potential consolidation and a possible move downward toward the middle band. The Relative Strength Index (RSI) remains at 69, reflecting a neutral position for the pair.

Resistance: $2,021, $2,038

Support: $2,007, $1,988

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Consumer Confidence | 23:00 | 101.0 |