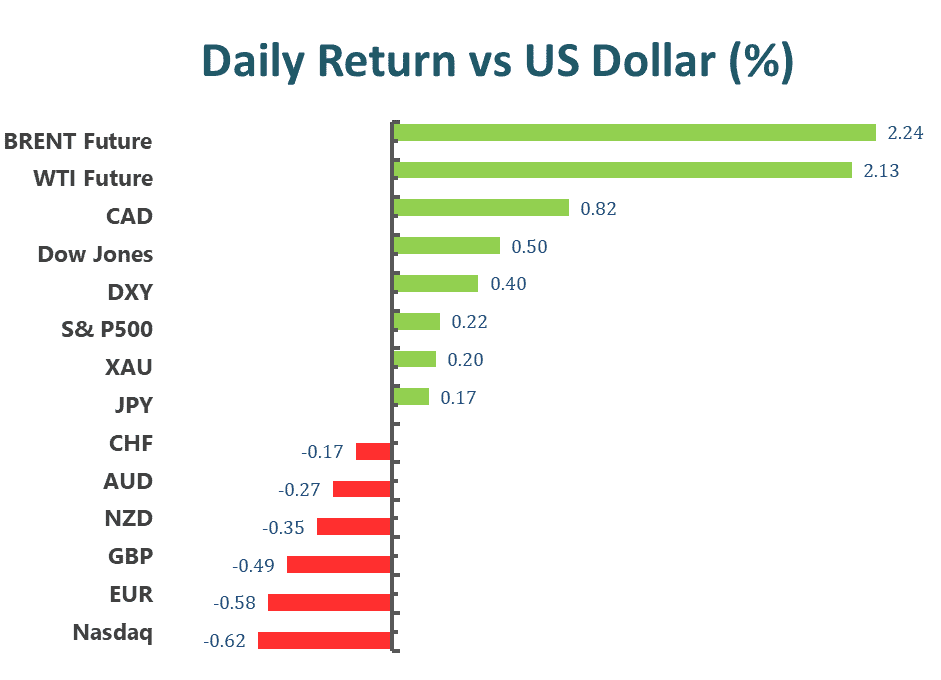

The Dow closed flat Wednesday, as investors weighed up the Federal Reverse’s widely expected quarter-point rate hike and Fed Chairman Jerome Powell’s lack of pushback on the recent rally in stocks and easing financial conditions.

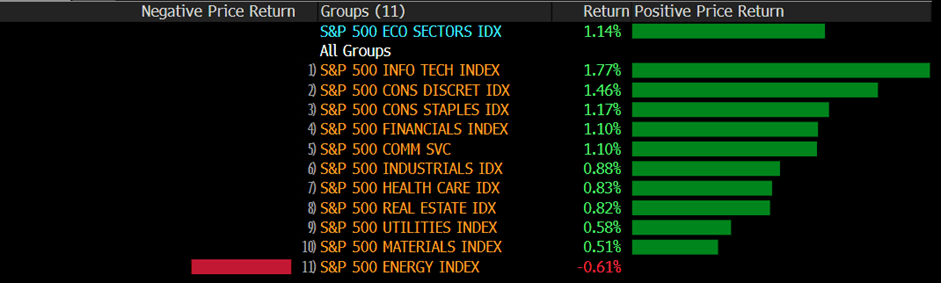

The Dow Jones Industrial Average was up 0.02%, or 6 points, the S&P 500 rose 1.1%, and the Nasdaq Composite rose 2%.

On the economic front, data continued to show the labor market running hot. Weekly job openings and the December private jobs report came in better than expected, threatening to boost wage pressures and inflation.

Monetary policy decisions from other major central banks and US Nonfarm Payrolls will be crucial for clear directions.

The energy was the only sector in the red, falling more than 2% as oil prices fell after U.S. weekly crude stockpiles increased more than expected and OPEC and its allies stuck with their output policy unchanged. Final return rate at -1.89%.

Main Pairs Movement

DXY holds lower grounds near 100.90 as traders lick their wounds near the lowest levels since April 2022 during Thursday’s Asian session. At the time of writing, the DXY price at 102.205, dropped around 0.9% on the daily chart.

EUR/USD bulls cheer the Federal Reserve’s acceptance of easing price pressure, as well as Chairman Jerome Powell’s readiness for rate cuts if needed, by rising the most since November 2022 to poke the highest levels in 10 months, making rounds to 1.1000.

GBP/USD rallied overnight on US Dollar weakness following the Federal Reserve event. The pair burst through 1.2350 resistance. GBP/USD now depends on the Bank of England and US jobs data on Friday. At the time of writing, the price at 1.23822.

Gold price makes rounds to the highest levels since late April 2022, close to $1,955 during the mid-Asian session on Thursday. At the time of writing, the price trades at 1955.06.

Technical Analysis

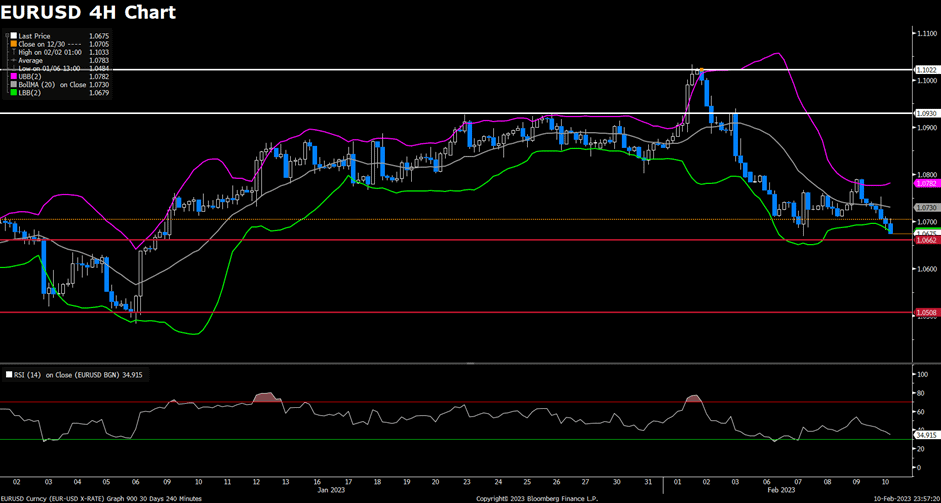

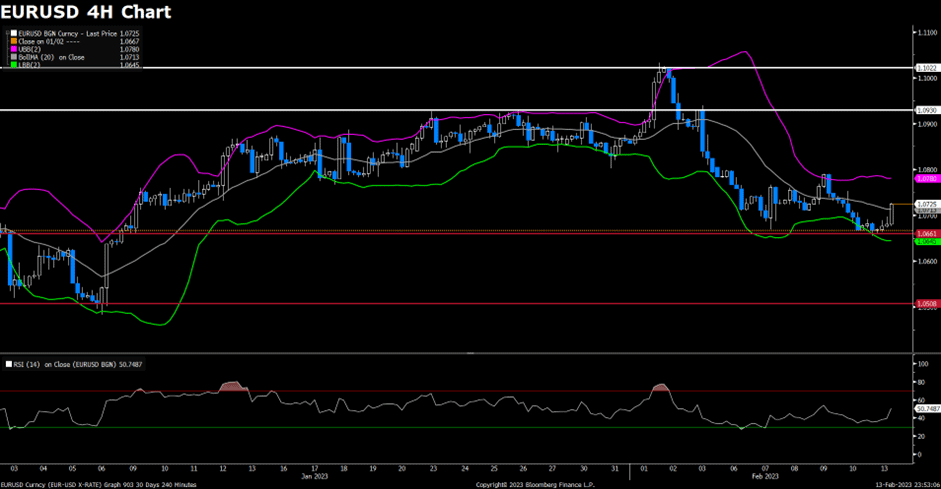

EURUSD (4-Hour Chart)

The EUR/USD pair advanced higher on Wednesday, preserving upside momentum, and hit fresh highs above the 1.0910 mark after the release of US economic data. The pair is now trading at 1.0919, posting a 0.54% gain on a daily basis. EUR/USD stays in the positive territory amid a weaker US Dollar across the board, as the greenback lost its strength and stayed on the back foot following the disappointing Manufacturing PMI data. Meanwhile, the ADP employment report showed US private sector added 106K jobs in January, which is below the market expectation for an increase of 178K and also the lowest reading since January 2021. Investors are now waiting for the US Federal Reserve to announce its policy decisions following the first meeting of the year, as the central bank is expected to slow the pace of tightening further and deliver a 25 bps rate hike. In the Eurozone, the European Central Bank is also expected to raise interest rates by 50 basis points on Thursday as policymakers recently commented that more significant rate hikes are on the table.

For the technical aspect, RSI indicator 64 figures as of writing, suggesting that the risk skews to the upside as the RSI is rising sharply towards 70. As for the Bollinger Bands, the price moves out of the upper band, therefore a strong upside trend continuation can be expected. In conclusion, we think the market will be bullish as the pair is now testing the 1.0918 resistance level. Technical indicators also crossed their midlines into positive territory, which reflects bull signals.

Resistance: 1.0918, 1.0943, 1.1003

Support: 1.0830, 1.0780, 1.0722

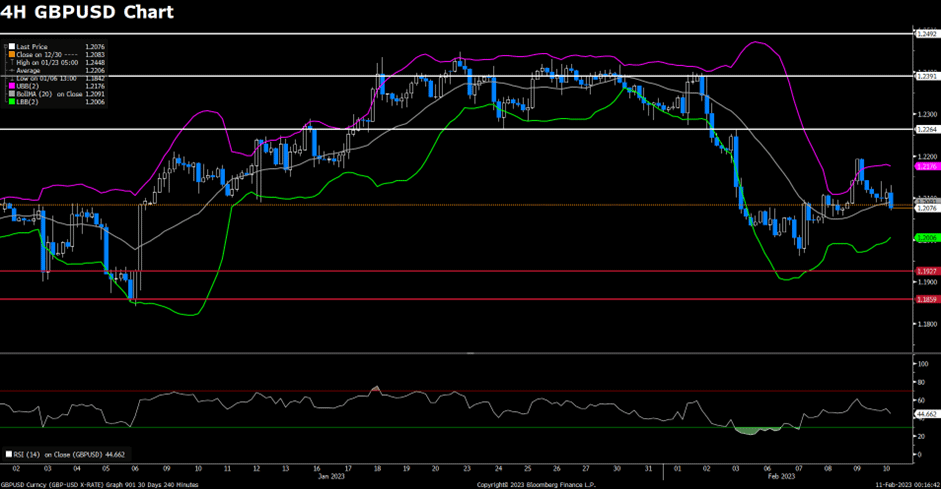

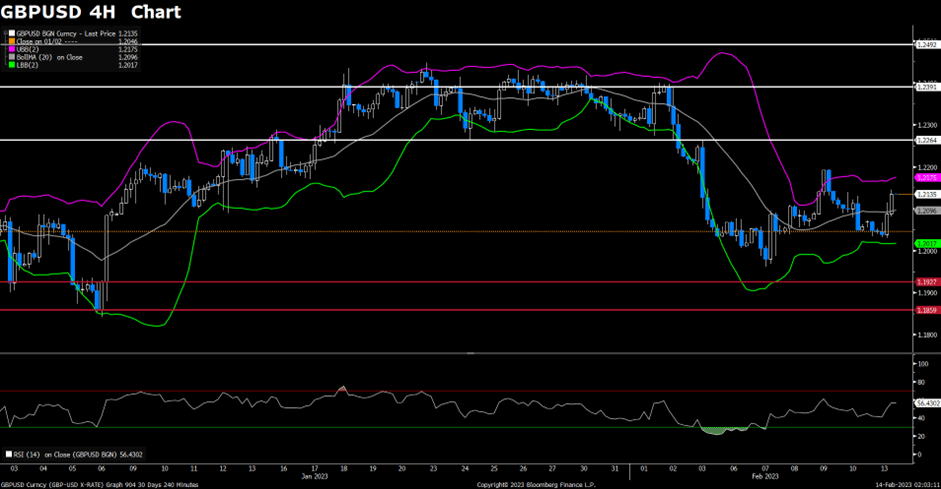

GBPUSD (4-Hour Chart)

GBP/USD maintains nonvolatile ahead of the FOMC decision. The pair trimmed early gains and holds above 1.2300 on cautious market sentiment. The Fed is widely expected to raise interest rates by 25 bps amid signs of easing inflationary pressures. The bets were cemented by the US wage growth data released on Tuesday, which showed that labor costs increased less than expected in the fourth quarter. On the other hand, traders also focus on BoE Interest Rate Decision on Thursday. The BoE is estimated to raise rates by 50bps, leaving the Bank Rate at 4%. This and Fed Interest Rate Decision will provide some meaningful impetus to GBP/USD.

For the technical aspect, RSI indicator 36 figures as of writing, falling below mid-line on a continued downside correction. As for the Bollinger Bands, they are edging lower between the downward moving average and lower band, signaling that the bearish trend is more favored. A downtrend could persist. In conclusion, we think the market is in modest bearish mode as both indicators show some bearish potential. The pair is currently trading in a narrow range. A firm break out of the range is needed to confirm the follow-through trend. For the uptrend scenario, the price needs a firm break above resistance at 1.2426 to show bullish impetus. For the downtrend scenario, if the price drop below the support at 1.2292, it may trigger some technical selling and drag the GBP/USD pair further toward the next support at 1.2188.

Resistance: 1.2426, 1.2493, 1.2593

Support: 1.2292, 1.2188, 1.2000

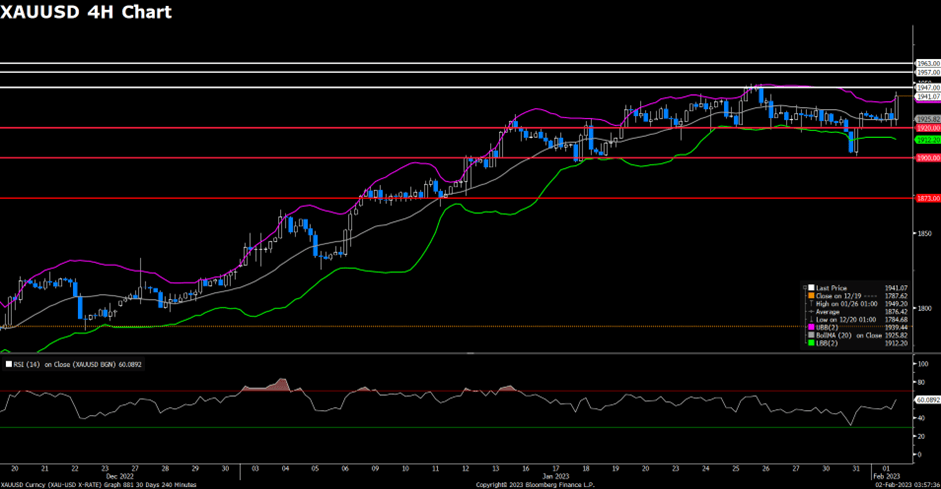

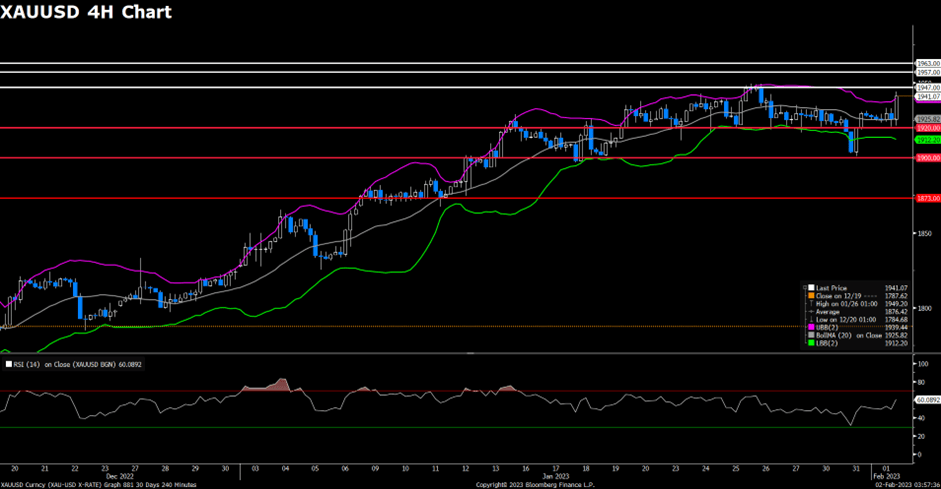

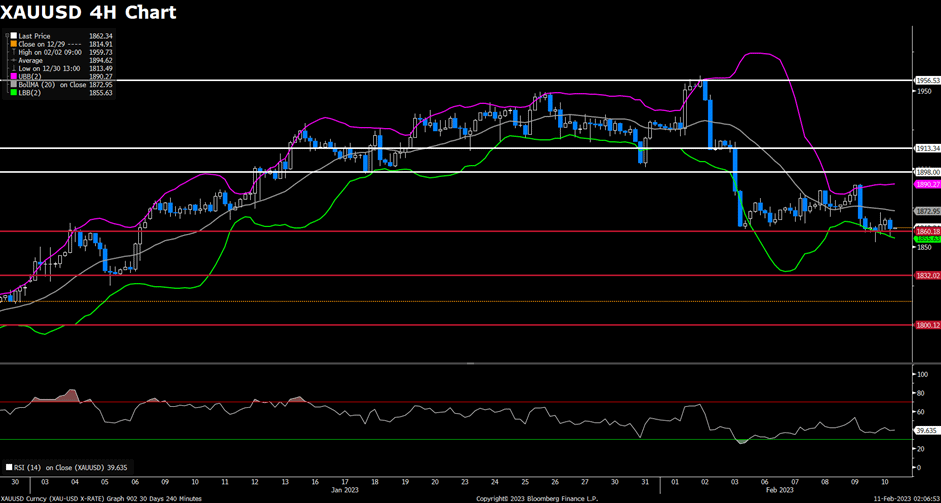

XAUUSD (4-Hour Chart)

Gold rises to $1,940 area after Fed Interest Rate Decision. Following the Fed’s decision to raise interest rates by 25 bps, the benchmark 10-year US Treasury bond yield drops 3.25% to below 3.4%, helping the Gold price push higher. Meanwhile, the US dollar index declines 0.85% to 101.221, which also favors the dollar-denominated gold. At the time of writing, the Gold price is trading at $1,940.07, posting a 0.65% gain on a daily basis.

For the technical aspect, the RSI indicator is 60 figures as of writing, advancing to a bullish region from mid-line on bullish price action. As for the Bollinger Bands, the price surged to the upper band from the moving average, showing strong bullish momentum. In conclusion, we think the market is in bullish mode. A continued rise could be expected. For the uptrend scenario, the pair is testing resistance at $1,947. A firm break above the level could trigger some follow-through buying and push gold higher toward the next resistance at $1,957. For the downtrend scenario, the current support is at $1,920. If the Gold price closes below $1,920 on the 4H chart. It may trigger some technical selling and drag the pair toward critical support at $1,900.

Resistance: 1947, 1957, 1963

Support: 1920, 1900, 1873

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | BoE Interest Rate Decision (Jan) | 20:00 | 4.00% |

| GBP | BoE MPC Meeting Minutes | 20:00 | |

| EUR | Deposit Facility Rate (Feb) | 21:15 | 2.50% |

| EUR | ECB Marginal Lending Facility | 21:15 | |

| EUR | ECB Monetary Policy Statement | 21:15 | |

| EUR | ECB Interest Rate Decision (Feb) | 21:15 | 3.00% |

| USD | Initial Jobless Claims | 21:30 | 200K |

| EUR | ECB Press Conference | 21:45 | |

| GBP | BoE Gov Bailey Speaks | 22:15 | |

| EUR | ECB President Lagarde Speaks | 23:15 |