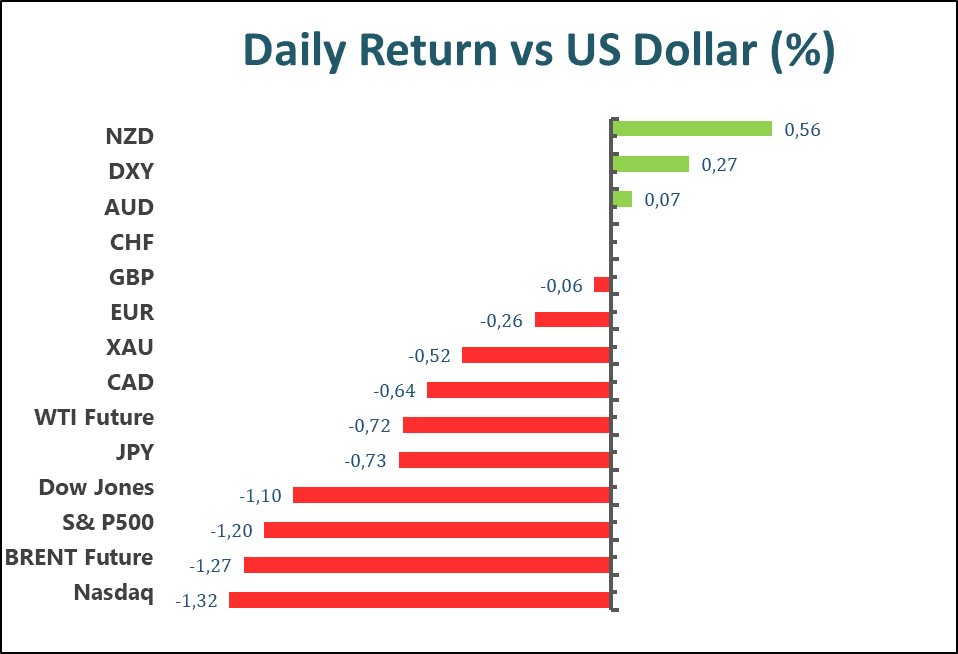

US stocks rose in a broad-based rally and Treasury yields fell as data allayed fears of a supercharged jobs market that would support a more aggressive policy path. A gauge of the dollar fell. Investors took solace in US jobs data that failed to reveal unwanted surprises while underscoring the resilience of the labour market in the face of the Federal Reserve’s aggressive monetary tightening. Initial unemployment claims rose slightly to 225,000, in line with expectations, in the week ended Dec. 24.

Continuing claims rose to 1.7 million in the week ended Dec. 17, the most since early February. The rally is a ray of light as a dismal year for stocks and bonds draws to a close. Global equities have lost a fifth of their value in 2022, the largest decline since 2008 on an annual basis.

The benchmark, the S&P500 rallied with a 1.75% daily gain on Thursday. All eleven sectors in S&P500 stayed in the positive territory, with the Communication Service and Information technology section performing the best among all groups, rising 2.69% and 2.64% respectively for the day. Apart from this, the tech-heavy Nasdaq 100 outperformed, surging by 2.54% on a daily gain.

Trade CFD with VT Markets

Main Pairs Movement

The US Dollar slid with 0.49% daily losses on Thursday, as US data showed the resilience of the labour market. The DXY index suffered heavy selling pressures all day, touching a daily low level below 103.8.

The GBPUSD edged higher with 0.31% daily for the day, as a decent recovery in the risk appetite theme. The pair regained mildly positive momentum in the late UK trading session, ending around the 1.2045 level. Meanwhile, the EURUSD witnessed fresh transactions since European trading hours and touched a daily high level of 1.069. The pair ended the day with a 0.46% daily gain.

The gold surged by 0.59% daily on Thursday, as the greenback stayed on the back foot, which provide support for the dollar-denominated yellow metal. The XAUUSD gained upside traction during the late European session, once reaching a daily high of $1820 marks in the middle of US trading hours.

Technical Analysis

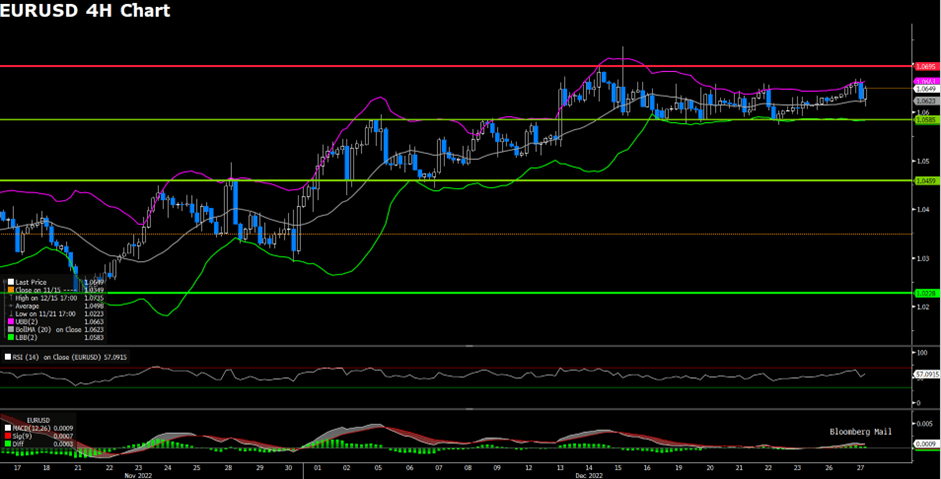

EURUSD (4-Hour Chart)

EURUSD raised $0.0049 and edged higher around 0.46% throughout Thursday’s trading. The EUR is holding gains against the dollar as market sentiment improves ahead of the final trading day of 2022. Data from the US showed a slight increase in jobless claims, boosting EUR/USD, while China’s Covid-19 easing made investors nervous. In other places, Russia’s invasion of Ukraine has escalated with a news report of the shelling of Kyiv and other cities.

Meanwhile, the Eurozone economic calendar saw Spanish retail sales jump 3.8% month-over-month over the previous month’s 0.4%, while EU M3 money supply jumped to 4.8% year-over-year in November versus expectations of 5%.

On the technical side, EUR/USD is still trading unstable, as usually happened in the last ten days of trading of the year. However, the RSI indicators show that the common currency could start the new year at a higher as the RoC is flat. RSI for the pair sits at 64.52, as of writing. On the four-hour chart, EURUSD currently trades above its 50, 100, and 200-day SMA.

Resistance: 1.0695, 1.0736

Support: 1.0585, 1.0459

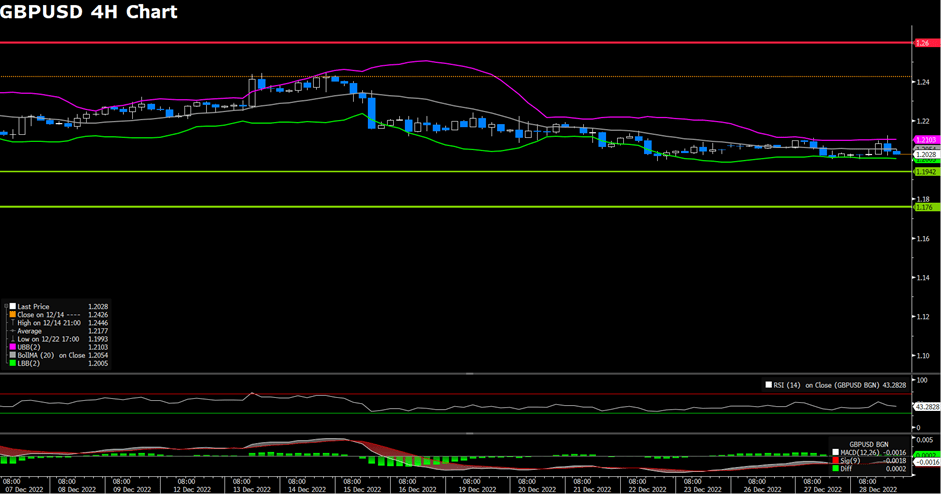

GBPUSD (4-Hour Chart)

The Pound remains sideways during the North American session after hitting a daily low of $1.2005 against the US dollar. However, the cable slightly raised by 18 pips after US initial jobless claims data was released on the 30 minutes chart. As of writing, the price sitting at $1.20707, raised around 0.45% in today’s trading course. On Friday, the UK economic docket is empty, while the US calendar will feature the Chicago PMI for December, estimated at 40.

On the other side, the GBP/USD is motivated by the US dollar due to the lack of UK economic data. The DXY a gauge that tracks the greenback value of a packet of six currencies tumbles 0.5% down to $103.8 as of writing. Weighed by falling US treasury yields. The US 10-year benchmark note rate drops 3.0 basis points to 3.85%.

On the technical side, from the daily chart, the GBP/USD upside was restricted by the 20 and 200-day EMA, each at $1.12111 and $1.2082. The RSI and RoC indicate that the cable is edging up, even though the short-side sellers are beginning to gather momentum. From the four-hour chart, the price level sits above the descending regression channel and is close to 20-day SMA. RSI for the pair sits at 54.74, as of writing. On the four-hour chart, GBPUSD currently trades above its 50, and 100-day SMA and just crossed its 200-day SMA.

Resistance: 1.2320, 1.2600

Support: 1.19, 1.176

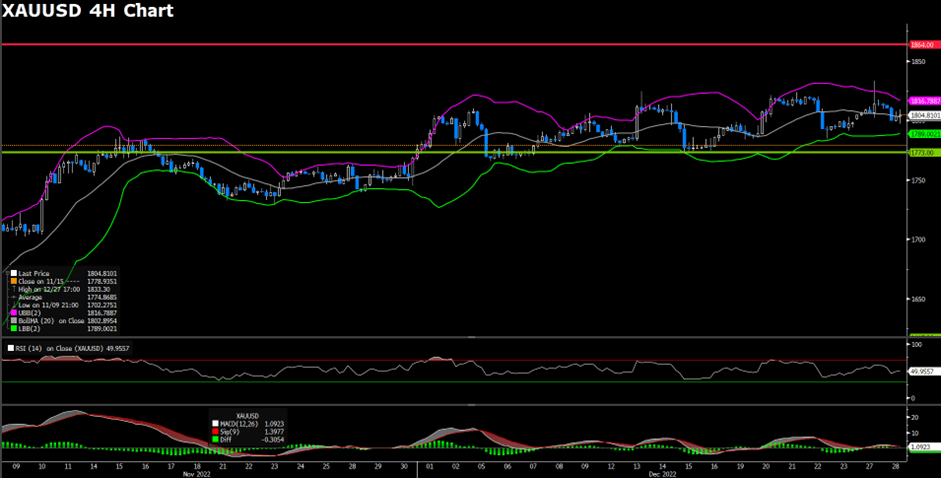

XAUUSD (4-Hour Chart)

Gold price raised over 0.8% to $1,820 during today’s trading course as of writing. As US 10-year treasury yields edge lower 3.0 basis points to 3.85%, probes the DXY bulls and puts a floor under the gold price. Also, the US weekly initial jobless claims-related data with 225K meet markets’ expectations. Which gave the investors the belief that the Fed may ease the fighting strength against inflation, leading the greenback to devaluation, and DXY falls over 0.5% down to $103.8 as of writing.

On the other hand, should keep an eye on China’s Zero-Covid policy, as around seven major nations have recently announced Covid test requirements for Chinese travellers as the virus cases swirl in the dragon nation. a top official from the Chinese Center for Disease Control and Prevention recently warned of Covid spreading throughout the holiday season. The diplomat, however, also mentioned that the covid virus outbreaks have peaked in Beijing, Tianjin and Chengdu.

On the technical side, a three-week-old ascending triangle restricts Gold prices between $1,782 and $1,825. That means the XAU/USD currently fades bounce off a fortnight-old upward-sloping support line inside the stated triangle. RSI sits at 59.21 as of writing. On the four-hour chart, gold price trades above its 50, 100, and 200-day SMA.

Resistance levels: 1820, 1830

Support levels: 1792, 1785, 1773

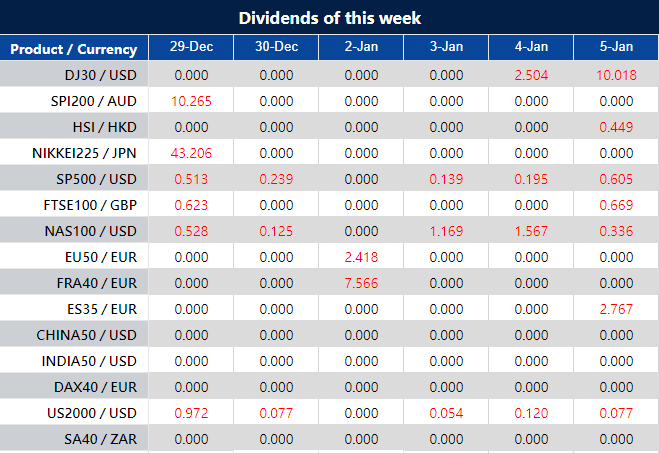

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Crude Oil Inventories | 00:00 | -1.250M |