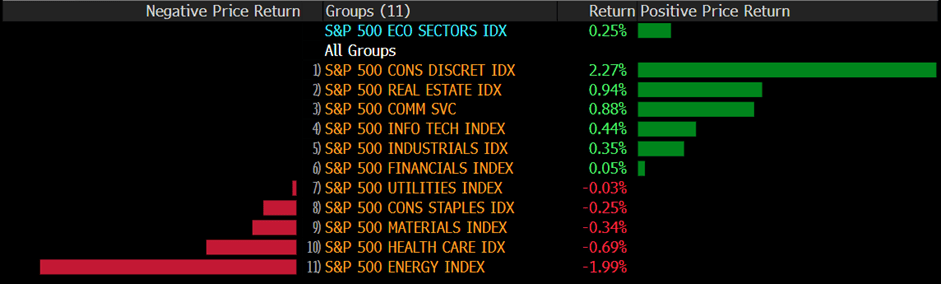

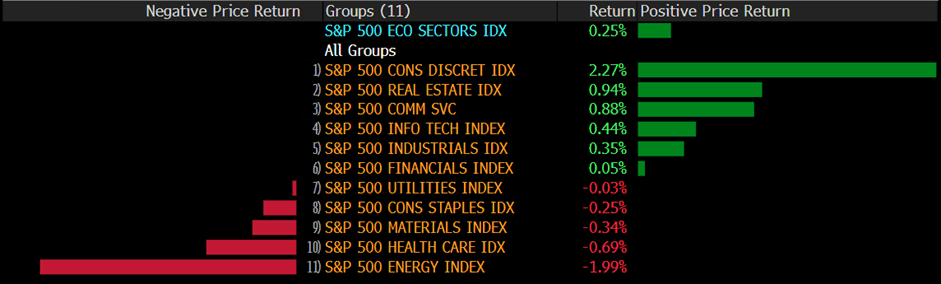

U.S. equities scored their best trading day of the year throughout last Friday’s trading. The Dow Jones Industrial Average climbed 2.13% to close at 33630.61. The S&P 500 gained 2.28% to close at 3895.08. The tech-heavy Nasdaq composite jumped 2.56% to close at 10569.29. U.S. equities rose after the U.S. nonfarm payrolls and unemployment change data both indicated higher employment during the previous month.

The nonfarm payrolls came in at 223K, while the monthly unemployment change came in at 3.5%. Furthermore, the ISM PMI figure came in below market expectations at 49.6, indicating a slowdown in private-sector purchasing. Market participants assumed that the higher employment and falling private sector purchasing would prompt the Fed to throttle back on interest rate controls, thus equities rallied while treasury yields and the Greenback retreated.

The benchmark U.S. 10-year treasury yield was last seen trading at 3.56%, while the 2-year yield sits at 4.258%.

On the economic docket, Fed chairman Jerome Powell is due to speak during the American trading session on the 10th. The U.S. will release core CPI and initial jobless claims figures on the 12th, and the U.K. will release GDP and manufacturing figures on the 13th.

Main Pairs Movement

The Dollar index, which tracks the U.S. Greenback against a basket of major foreign currencies, slumped 1.18% throughout Friday. Market participants sold the Greenback after the “Fed desired” U.S. economic data released throughout Friday’s American trading session. Retreating U.S. yields acted as a headwind for the falling Dollar.

EURUSD jumped 1.12% throughout Friday’s trading. The Dollar weakness across markets allowed Euro bulls to bid the Euro higher and allowed the pair to reverse a four-day loss.

GBPUSD soared 1.54% throughout Friday’s trading. While there were no major economic data releases from the U.K., the lower-than-expected U.S. PMI data sparked a selloff of the Dollar.

Gold climbed 1.82% throughout Friday’s trading. The Dollar denominated Gold soared after a broad-based selloff of the U.S. Greenback.

Technical Analysis

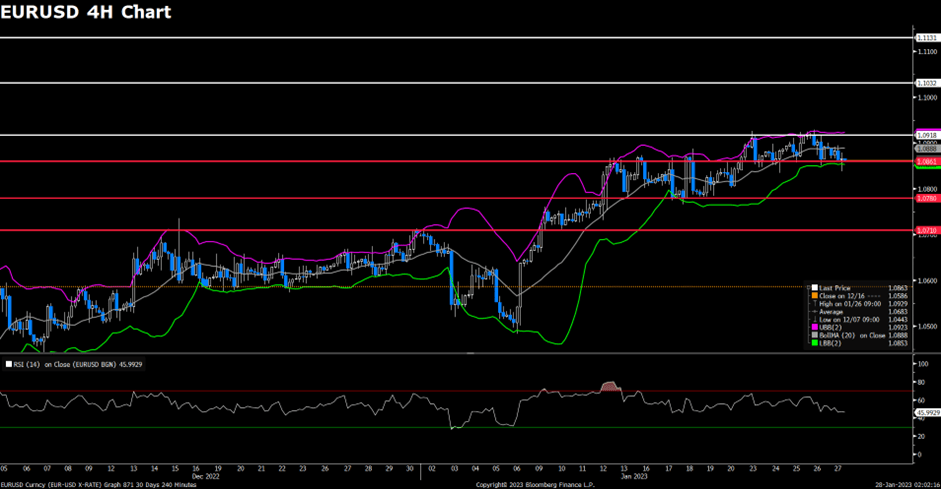

EURUSD (4-Hour Chart)

The EUR/USD pair advanced higher on Friday, regaining upside traction and recovered towards the 1.0600 mark after the release of the US NFP report. The pair is now trading at 1.0609, posting a 0.85% gain daily. EUR/USD stays in the positive territory amid weaker US dollars across the board, as the US job data weakened the US Dollar even though the labour market remains tight. The US Nonfarm Payrolls rise by 223,000 in December, which came in much higher than the market expectation of 200,000 and exerted bearish pressure on the greenback. The upbeat employment figures caused investors to reassess the Fed’s policy outlook as the CME Group FedWatch Tool’s probability of a 25 basis points Fed rate hike in February declined to 57% from 70% on Wednesday. In the Eurozone, the Eurozone Consumer Price Index (CPI) for December came at 9.2%, which was lower than expected but failed to drag the EUR/USD pair lower amid the renewed US dollar weakness.

For the technical aspect, the RSI indicator is 54 figures as of writing, suggesting the pair could extend its daily gains as the RSI is rising sharply. As for the Bollinger Bands, the price witnessed fresh buying and climbed above the moving average, therefore a continuation of the upside trend can be expected. In conclusion, we think the market will be bullish as the pair is testing the 1.0583 resistance. Euro bulls are now looking at the 1.0624 area which is the next resistance.

Resistance: 1.0583, 1.0624, 1.0710

Support: 1.0508, 1.0467

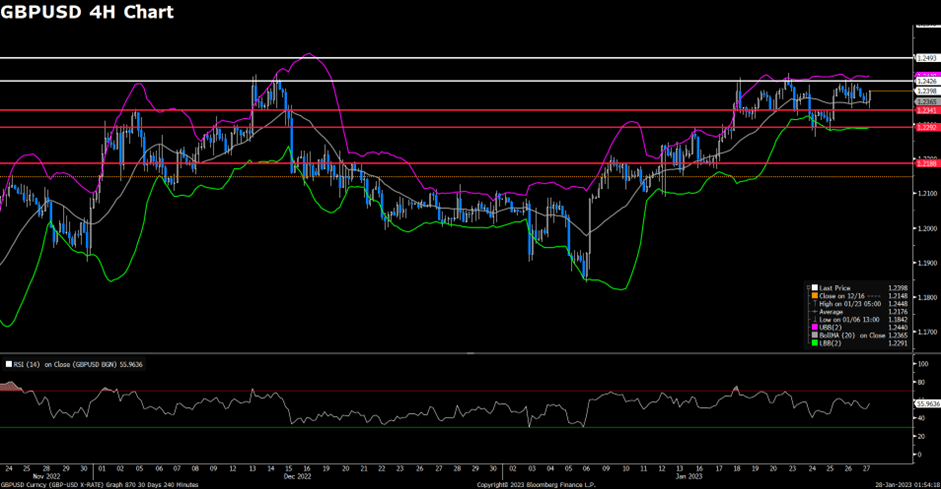

GBPUSD (4-Hour Chart)

GBP/USD recovers lost territory from Thursday’s losses, reclaims 1.12 on soft USD after US NFP report. US Nonfarm Payrolls rose by 223K, exceeding expectations, and pointing to a solid labour market. The unemployment rate fell to 3.5%, while Average Hourly Earnings fell to 4.6%, compared with expectations for 5%, suggesting that inflation on wages is easing. USD index dropped to around 104, which favours GBPUSD. The pair rose accordingly. At the time of writing, the pair is trading at 1.2071, posting a 1.5% gain daily.

For the technical aspect, the RSI indicator is 60 figures as of writing, rebounding from the oversold zone. The RSI indicator rose sharply, indicating the pair may continue on its upward traction. For the Bolling Bands, the price rose sharply through the average from the lower bound. A continuing upward trend could be expected. For the price action, the pair recover lost territory below a first support level and is now hovering around 1.21 at the time of writing, close to the first resistance level at 1.2110. In conclusion, we think GBPUSD is in bullish mode. Based on the technical analysis, there is a high possibility to break through the first resistance of 1.2110. On the upside, if the price advance above the resistance level at 1.2110 on 4H Chart, it may head to test the next resistance at 1.2233.

Resistance: 1.2110, 1.2233, 1.2335

Support: 1.1927, 1.1765

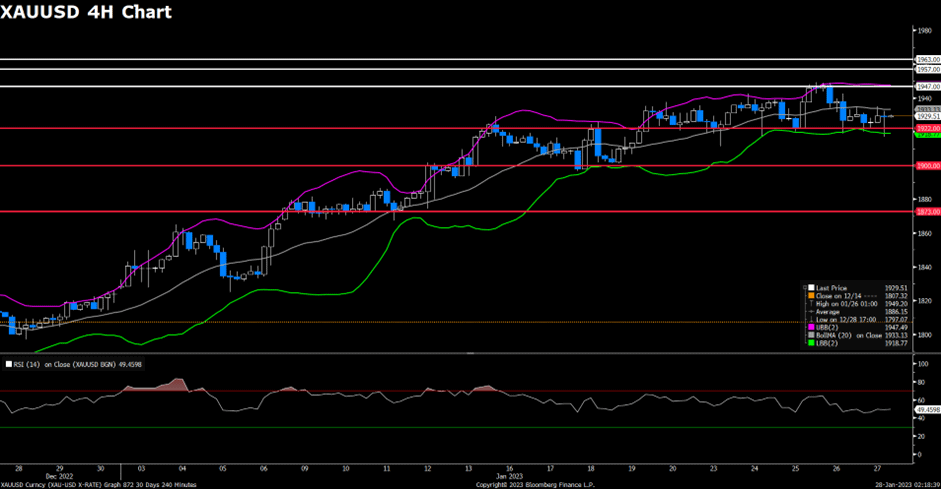

XAUUSD (4-Hour Chart)

The gold price soared on the solid US NFP data. In the US trading session on Friday, the US Bureau of Labor Statistics revealed that US Nonfarm Payrolls rose by 223K, exceeding expectations. The unemployment rate fell to 3.5%, while Average Hourly Earnings fell to 4.6%, compared with expectations for 5%, suggesting that inflation on wages is easing. Markets reacted to the US economic figures. The US dollar index dropped to around 104, while the US 10-year yield rose from 3.73% to 3.57%. The gold price soared directly from $1,835 to $1,860, refreshing the highest level from last mid-June. At the time of writing, the price is hovering around $1,870.

For the technical aspect, the RSI indicator is 70 figures as of writing, rising from 50. The RSI indicator rose sharply, indicating the pair may continue on its upward traction. For the Bolling Bands, the price goes up along with the upward trading average and is now trading around the upper bound. For the price action, the pair rises sharply and makes a higher high on its pattern, which is a standard pattern for the upward trend. In conclusion, we think the gold price is in a bullish mode based on the technical analysis, and there is a high possibility to continue on its upward trend. That said, the RSI indicator and Bolling Bands both show signs of being overbought. Traders should be aware of the risk of a correction.

Resistance: 1874, 1884

Support: 1775, 1735, 1700