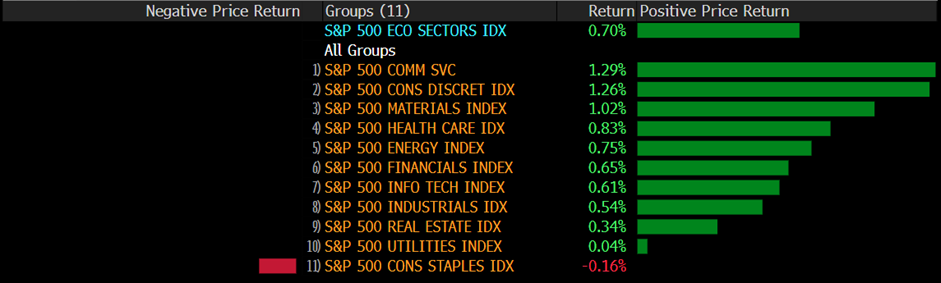

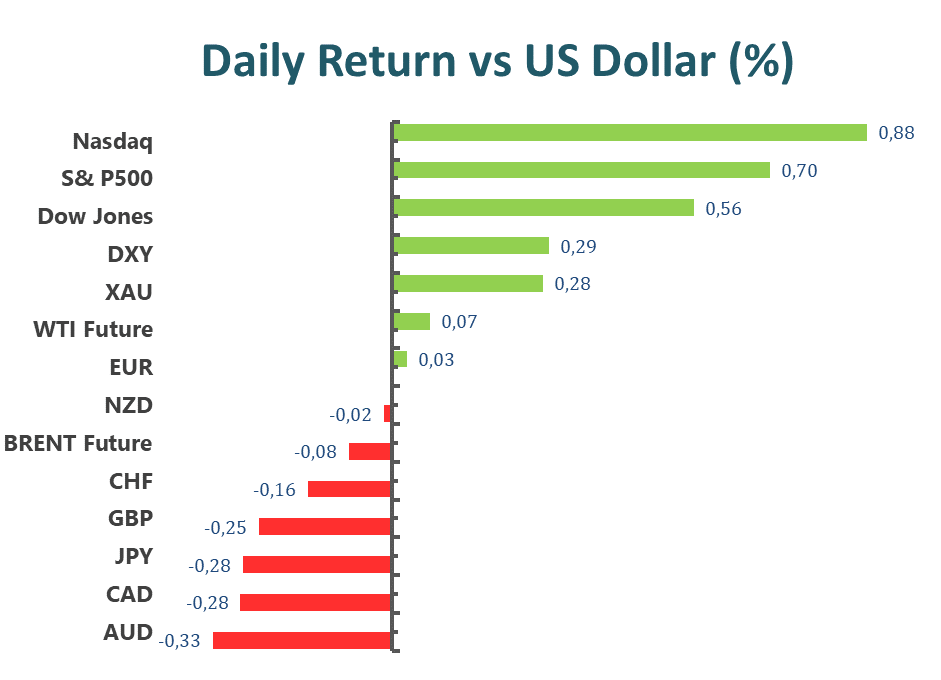

U.S. equity indices marched higher throughout Wednesday’s trading. Markets continue to expect risk-on sentiment before the release of the U.S. CPI report, which is scheduled to be released during today’s American trading session. The Dow Jones Industrial Average rose 0.8% to close at 33973.01. The S&P 500 climbed 1.28% to close at 3969.61. The tech-heavy Nasdaq Composite jumped 1.76% to close at 10931.67.

Market participants are pricing in a softer reading for the CPI report, which would aid the rhetoric of a slower interest rate hike by the Fed; however, recent remarks from Fed FOMC members have continued to point towards a higher terminal rate. Professionals across industries have also called for the Fed to pause interest rate hikes to access the impact of 2022’s interest rate hike effects. A more conclusive result should come soon, though, as late January and February roll around the corner, corporations will soon release their 2022 Q4 earnings.

The benchmark 10-year treasury yield has retreated below 3.6% and was last seen trading at 3.55%, while the short-term 2-year treasury yield was last seen trading at 4.288%.

Bank of America, JP Morgan Chase, Wells Fargo Corp., and Citi Group Inc. will headline earnings on the 13th.

Main Pairs Movement

The Dollar index, which tracks the U.S. Greenback against a basket of major foreign currencies, traded mostly sideways throughout the 11th. The Dollar index notched a 0.1% gain and is currently trading around the 103.2 range.

EURUSD gained 0.22% throughout yesterday’s trading. Falling U.S. yields and falling short-term interest rate expectations have allowed the Euro to gain against the Dollar for four straight sessions.

GBPUSD saw minimal price movements throughout Wednesday’s trading. The British Pound could not gain much ground against the Dollar, despite a broadly weakened Dollar.

Gold lost 0.05% throughout yesterday’s trading. The Dollar denominated Gold has reached its short-term resistance level at $1880 per ounce and is currently consolidating around the $1876 per ounce price region.

Technical Analysis

EURUSD (4-Hour Chart)

The EUR/USD pair advanced higher on Wednesday, preserving bullish momentum and climbed to its highest level since late May above the 1.0770 mark amid expectations for less aggressive policy tightening by the Federal Reserve. The pair is now trading at 1.0756, posting a 0.22% gain daily. EUR/USD stays in the positive territory amid renewed US Dollar weakness, as the greenback continued to weaken after Fed Chair Jerome Powell’s speech on Tuesday failed to provide any forward guidance. In the meantime, Fed policymakers are revising their policy projections after a drop in wage inflation. On the economic data front, the crucial US CPI report on Thursday will play a key role in influencing the Federal Reserve’s rate-hike path and driving the price of the EUR/USD pair in the near term. A stronger US CPI print will lift bets for a more hawkish Fed. In the Eurozone, French central bank governor Francois Villeroy de Galhau said the ECB should aim to reach the terminal rate by the summer, confirming they would have to raise rates further in the coming months.

For the technical aspect, RSI indicator 67 figures as of writing, suggesting that the pair could witness more upside movements as the RSI stays near the overbought zone. As for the Bollinger Bands, the price regained upside traction and climbed towards the upper band, therefore the upside momentum should persist. In conclusion, we think the market will be bullish as the pair is now testing the 1.0750 resistance level. Technical readings in the 4-hour chart also reflect bulls’ control.

Resistance: 1.0750, 1.0787

Support: 1.0710, 1.0584, 1.0508

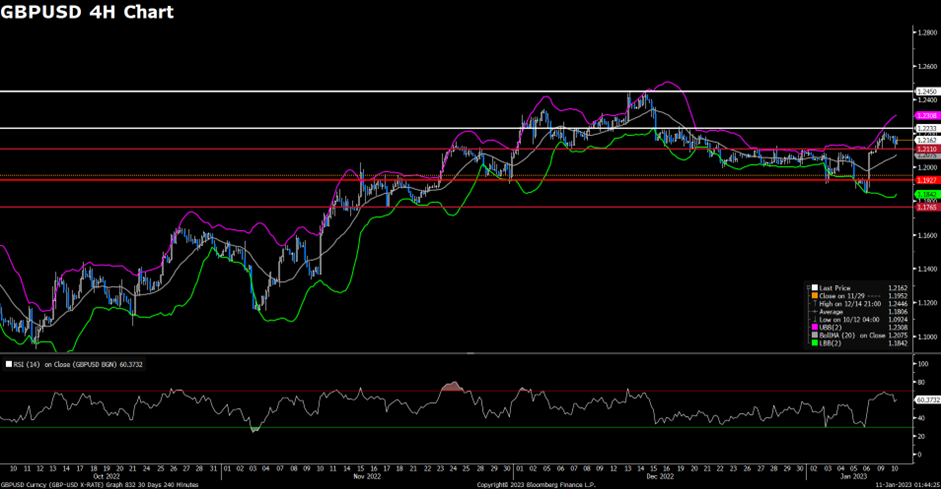

GBPUSD (4-Hour Chart)

GBP/USD went flat around the price at 1.2125, since the Fed’s Powell speech did not provide any forward guidance for the February 1 FOMC meeting, after hitting a daily high of 1.2178, the selling pressure dragged the GBP/USD down, however, this pair rebounds toward 1.2150 as US Dollar weakens and hit the support at 1.211, and it might be a signal of sizeable correction. As the global monetary policy tightening cycle matures, the first half of this year will go bearish and the second half will have some strength emerging against a generally overvalued USD since the investors will expect an easier Fed policy and move out of the Greenback.

For the technical aspect, RSI indicator 14 figures as of writing, it’s a suggestion of strong buying signals and indicates there will be an oversold or undervalued condition, estimated to be bullish and will rebound from the bottom. However, as for the Bollinger Bands, it’s closing, which indicates the volatility f this pair is going smoothly, it may be the consequence of the periods of high volatility from the last few days. In the US, the last speech of the Fed’s Powell on Tuesday did not provide any forward for the FOMC meeting, and a lack of fundamental drivers and high-tier data releases, however, investors could stay on the sidelines and the main indexes could have a hard time making a decisive move in either direction. On the UK side, the monthly GDP and the yearly Manufacturing Production will be the key short-term indicator for Pounds.

Resistance: 1.2233, 1.2450

Support: 1.2110, 1.1927, 1.1765

XAUUSD (4-Hour Chart)

Gold prices have no clear direction on Wednesday as the market is lack consensus before US key event-CPI report. The earlier gold price soared to $1,886.59, a multi-month high, and then started to decline in the US trading session. At the time of writing, the gold price is trading at $1,877.17. Market participants now focus on US inflation figures. The crucial US CPI report on Thursday will play a key role in influencing the Federal Reserve’s rate-hike path and driving Gold prices in the near term. A stronger US CPI print would increase bets on a more hawkish Fed and therefore weighting on the gold price.

For the technical aspect, RSI indicator 59 figures as of writing, holding slightly above the mid-line, suggesting that the pair is in bullish mode but has no strong momentum. For the Bolling Bands, the price is hovering between the upward average and upper bound. The upward trend should persist. For the price action, the price tried to make an upward breakthrough but fail as traders would not place aggressive bets ahead of the key event risk. In conclusion, we think the gold price is still in a bullish mode based on the technical analysis. For the uptrend scenario, the price needs a decisive breakthrough to trigger the follow-through buy interest. For the downtrend scenario, a trader should aware of the key level at $1,830. If the price drop below this level on the 4H chart, it may change the current trend. That said, the focus remains on consumer inflation figures from the US, which will directly influence the financial market.

Resistance: 1879, 1889

Support: 1830, 1775, 1735

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Core CPI (MoM) (Dec) | 21:30 | 0.3% |

| USD | CPI (YoY) (Dec) | 21:30 | 6.5% |

| USD | CPI (MoM) (Dec) | 21:30 | 0.0% |

| USD | Initial Jobless Claims | 21:30 | 215K |