U.S. equities enjoyed another rally on Friday to close the week on a positive note. The Dow Jones Industrial Average climbed 0.08% to close at 33978.08. The S&P 500 gained 0.25% to close at 4070.56. The tech-heavy Nasdaq Composite rose 0.95% to close at 11621.71. On Friday, Fed’s favorite U.S. inflation gauge, the U.S. PCE price index figure was released coming in at 0.3%, in line with broad market expectations.

Signs of slowing inflationary pressure have once again convinced market participants to bet on a softer Fed FOMC move this week. Markets are now broadly pricing in a more than 80% chance of a 25 basis point interest rate hike at the upcoming FOMC interest rate decision.

The benchmark U.S. 10-year treasury yield edged higher throughout Friday and was last seen trading at 3.509%. The policy-sensitive 2-year treasury yield sits at 4.213%, as of writing.

Mainland China will resume trading after a week-long Lunar New Year break. Market participants around the globe are now looking at China to extend the January rally into February. Over this Lunar New Year break, consumer spending has outpaced the comparable period in 2019, providing a whiff of optimism for the week ahead.

Earnings season continues with Alphabet Inc headlining today’s earnings. Alphabet Inc. will report earnings after the market closes. Wallstreet analysts are predicting an EPS of 1.21.

Main Pairs Movement

The Dollar index, which tracks the U.S. Greenback against a basket of major foreign currencies, gained 0.1% throughout last Friday’s trading. The Dollar moved higher despite the U.S. PCE index showing inflation rising at the slowest rate since October 2021; furthermore, the Core PCE, which excludes the volatile food and energy prices, increased 0.3%, month over month, also in line with market expectations.

EURUSD retreated 0.21% throughout last Friday’s trading. The Euro fared worse against the Dollar as the Greenback gained attraction amid weaker consumer spending and softening price pressure.

GBPUSD lost 0.15% throughout last Friday’s trading. The cable could not hold on to gains from earlier last week and ended the week 0.07% lower as the Dollar regains traction.

XAUUSD lost 0.08% throughout last Friday’s trading. The yellow metal continued to lose ground after a 0.88% decline on the 26th. The haven asset now faces a critical support level at around the $1928 per ounce price region.

Technical Analysis

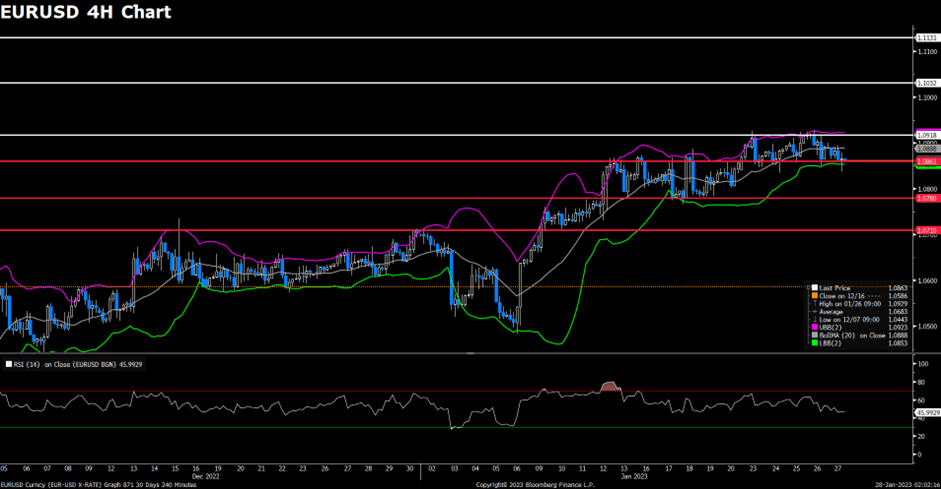

EURUSD (4-Hour Chart)

EUR/USD slid toward 1.086 on Friday. The US Dollar gathers support from the mostly upbeat US macro data released, which, in turn, exerts pressure on its rivals. On the other hand, expectations for a more hawkish European Central Bank (ECB) seem to provide some support to EUR/USD. The market focus is now shifting to the key central bank event risks next week. The Fed will announce its policy decision on Wednesday. This will be followed by the ECB Interest Rate Decision on Thursday, which will play a key role in determining the next traction for EUR/USD.

For the technical aspect, RSI indicator 46 figures as of writing, sliding to below the mid-line, signaling that the market is losing its upside traction. A downward correction could persist. As for the Bolling Bands, the price is now moving below the moving average. The upward momentum seems weak as the moving average keeps horizontal in the near term. In conclusion, we think EUR/USD is in correction mode since the price is edging lower toward the support at 1.0861. Besides, both the RSI indicator and Bolling Bands signal that the pair is under pressure. For the uptrend scenario, the pair is testing support at 1.0861. The bulls must defend this level first to retain control. For the downtrend scenario, if the price drop below the support at 1.0861, it may trigger some technical selling and drag the EUR/USD pair further toward the next support at 1.0710.

Resistance: 1.0918, 1.1032, 1.1131

Support: 1.0861, 1.0780, 1.0710

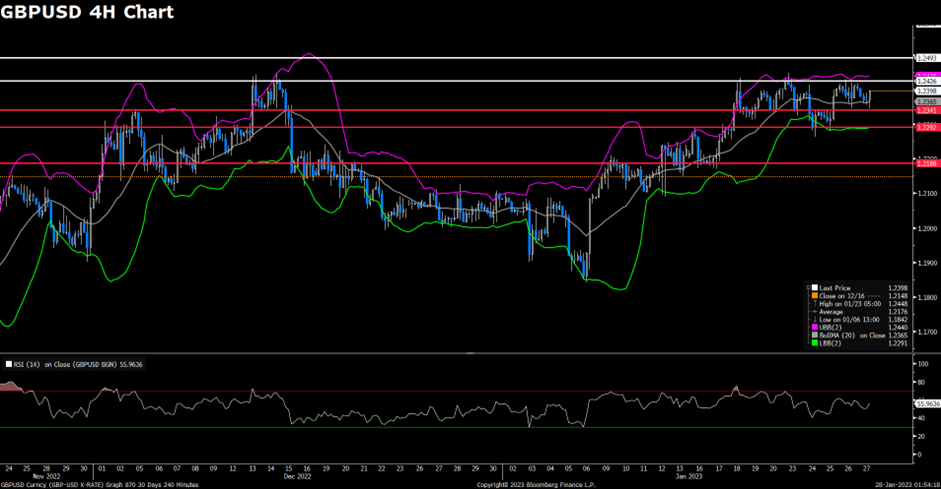

GBPUSD (4-Hour Chart)

The GBP/USD pair continues with its struggle to find acceptance above the 1.2400 mark and comes under some selling pressure on the last day of the week and is set to finish Friday with losses of at least 0.20% Though the inflation of the United States continues to wane but remains twice elevated of Fed’s target, the continue grows of this pair, close at 1.2406 at the end of Thursday then dropped toward 1.2370, break the support at 1.2341. The US Federal Reserve (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) for December, climbed 4.4% YoY, lower than November’s 4.7%, cementing the Fed’s cause of lower the size of subsequent interest rate increases, throughout the remainder of the year. Headline inflation rose by 5% YoY, well above the Fed’s target of 2%.

For the technical aspect, RSI indicator 56 figures as of writing, above mid-line, but signaling no strong upward momentum. As for the Bollinger Bands, the price holds around the horizontal moving average, indicating that the pair is under consolidation. In conclusion, we think the market is in consolidation mode until there is a decisive breakthrough to trigger follow-through buying or selling. For the uptrend scenario, the price needs a firm break above resistance at 1.2426 to show bullish impetus. For the downtrend scenario, if the price drop below the support at 1.2341, it may trigger some technical selling and drag the GBP/USD pair further toward the next support at 1.2292.

Resistance: 1.2426, 1.2493, 1.2593

Support: 1.2341, 1.2292, 1.2188

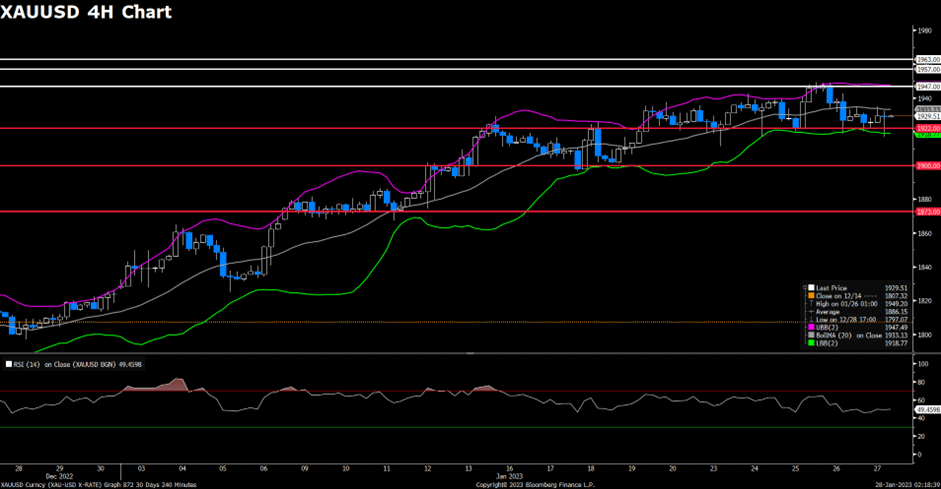

XAUUSD (4-Hour Chart)

Gold price struggles to gain upside traction on Friday. The US Dollar gathers support from the mostly upbeat US macro data released, which, in turn, exerts pressure on the dollar-denominated gold. Meanwhile, The benchmark 10-year US Treasury bond yield rise to above 3.5% ahead of the weekend, not allowing Gold to gain traction. At the time of writing, the gold price is trading at 1929.51, trying to defend the 1930 area. As for the economic calendar, the market focus is shifting to the key central bank event risks next week. The Fed will announce its policy decision on Wednesday. This will be followed by the ECB Interest Rate Decision on Thursday, which will play a key role in determining the next traction for Gold price.

For the technical aspect, RSI indicator 49 figures as of writing, close to mid-line, signaling the uncertainty of direction and the lack of main traction as the RSI indicator keeps moving up and down around mid-line for a while. As for the Bollinger Bands, the price is now moving below the moving average. The traction seems weak as the moving average keeps horizontal in the near term. In conclusion, we think the market is in modest bearish mode since both indicators show the uncertainty of traction and the price keeps edging lower. For the downtrend scenario, if the price drop below the support at $1922, it may trigger some technical selling and drag the Gold price further toward the next support at $1898.

Resistance: 1947, 1957, 1963

Support: 1922, 1898, 1873

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | German GDP (QoQ) (Q4) | 17:00 |