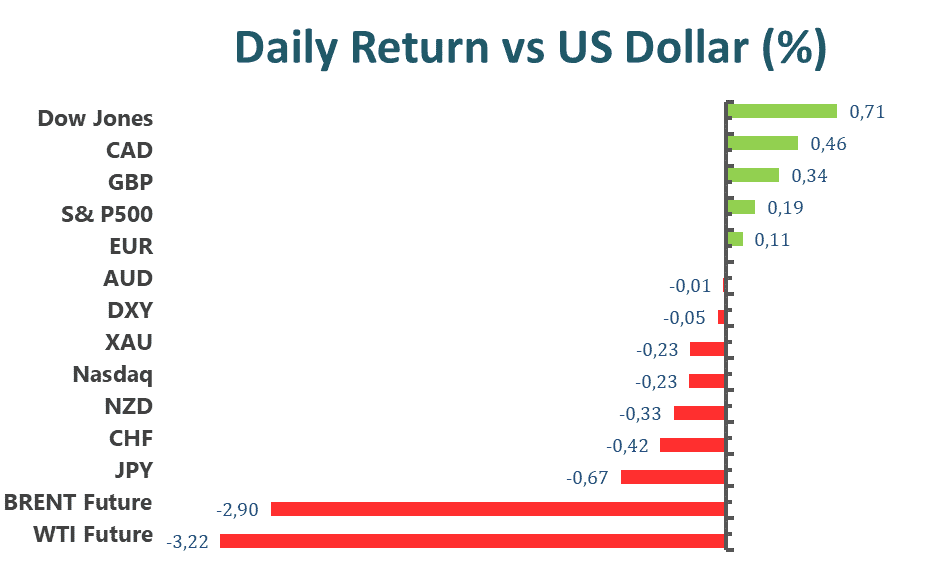

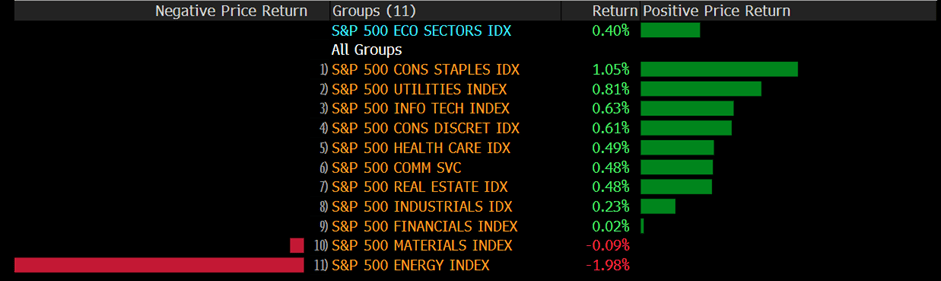

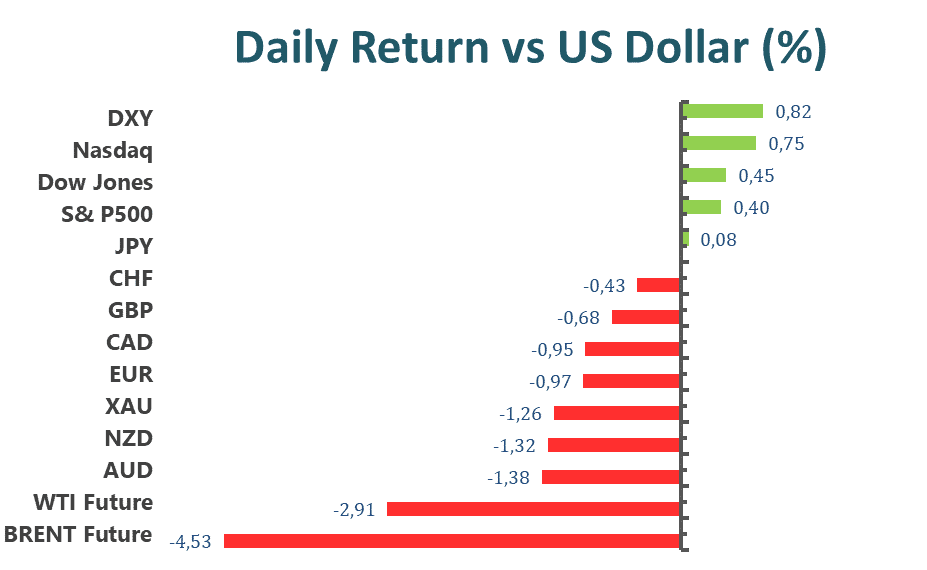

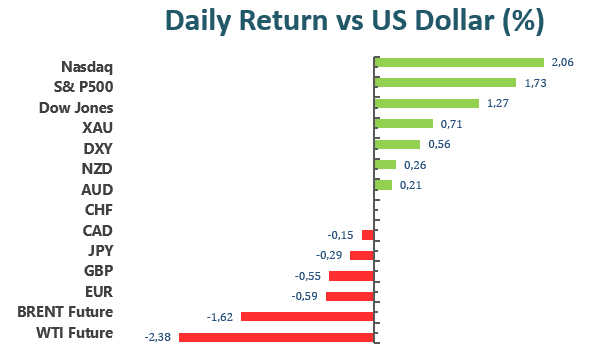

US stocks declined on Friday and snapped the longest weekly rally since November. Investors turned cautious and short-sellers resurfaced after Federal Reserve officials beat the drum on hiking rates. The pullback in equities this week follows a rally that has propelled the S&P500 from its mid-June nadir amid speculation that the Fed may scale back its aggressive path of rate hikes. However, more Fed officials joined the chorus of a hawkish stance in the runup to the annual symposium at Jackson Hole Aug. 25-27. Which makes a force that contributed to the rally now showing signs of fatigue, with hedge funds dialing down purchases of shares.

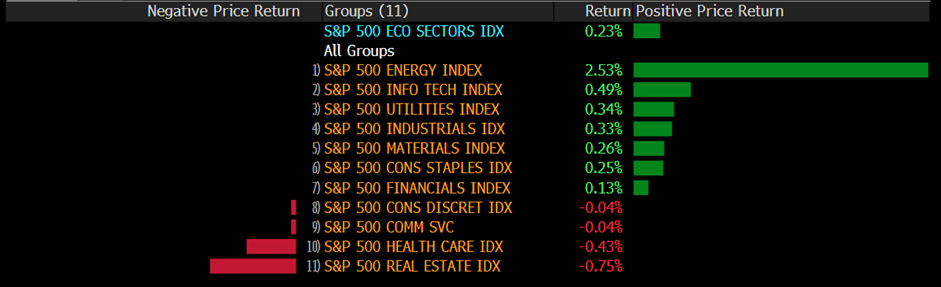

The benchmarks, S&P 500 and Dow Jones Industrial Average both dropped on Friday, as S&P500 notched its biggest daily decline since June, its first weekly loss in five weeks. Nine out of eleven sectors stayed in negative territory, and six of them fell more than 1% on daily basis. It’s worth noting that, the Consumers Discretion and Financials sectors performed the worst among all groups, sliding with 2.10% and 2.02% loss for the day. The Dow Jones Industrial Average fell 0.9%, the Nasdaq 100 dropped 1.9%, and the MSCI world index decreased 1.3% on Friday.

Main Pairs Movement

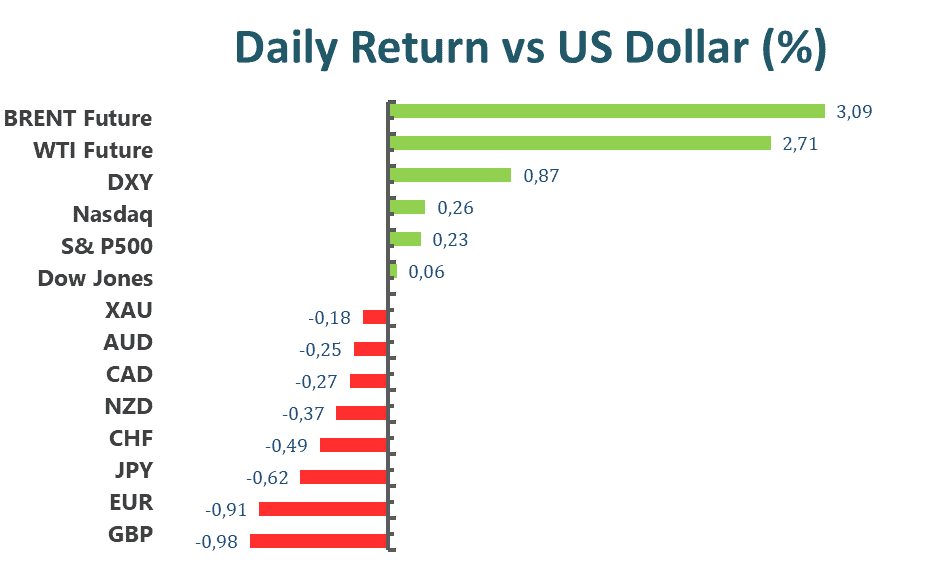

The US dollar surged on Friday, which posts the biggest weekly advance since April 2020. The minutes of the July meeting suggested that the Fed will continue to raise interest rates at the next few meetings, but the pace of the rate hikes will be data-dependent, which supports the greenback. The DXY index witnessed fresh transactions since the UK trading session and edged higher to a level above 108.1.

The GBP/USD dropped with a 0.85% loss on daily basis for the day, as sentiment shifted sour after Fed’s hawkish commentary. The cables were weighted to a daily low level below 1.180 during the middle of the US trading session as the strong US dollar across the board, then oscillate in a range from 1.181 to 1.184. Meantime, EUR/USD slid to a level below 1.004. The pair decreased by 0.50% on Friday.

Gold plunged 0.66% daily for the day, with a fifth-consecutive day as market mood amid a backdrop of fear and volatility. Although under selling pressure, XAU/USD observed fresh transactions before the US trading session and touched a daily high of $1,758 marks. However, gold then witnessed downside traction and fell to the daily low below $1,746 marks at the beginning of the US trading session.

Technical Analysis

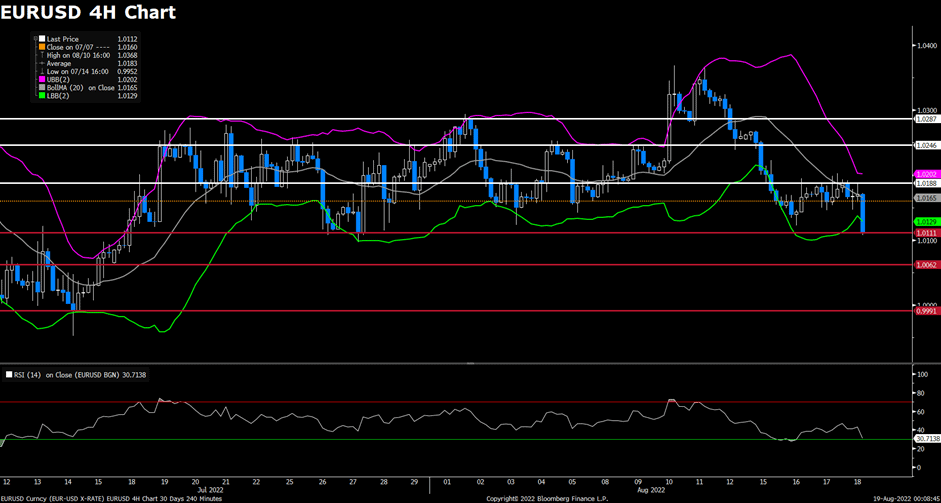

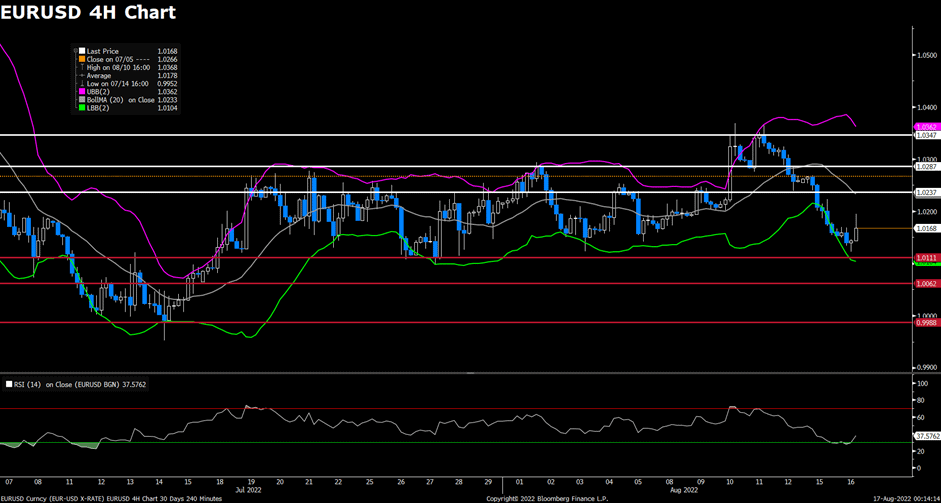

EUR/USD (4-Hour Chart)

The EUR/USD pair declined on Friday, extending its previous slide and held lower ground near the monthly low below the 1.005 mark amid fears of German recession and geopolitical concerns. The pair is now trading at 1.0048, posting a 0.36% loss daily. EUR/USD stays in the negative territory amid a stronger US dollar across the board, as the DXY just prints new multi-week tops above the 108.00 hurdle on Friday and exerted bearish pressure on the EUR/USD pair. The hawkish comments from the Fed policymakers in recent days continued to drive flows toward safety assets like the greenback, as markets seem convinced that the Fed will stick to its policy tightening cycle amid the incoming positive US macro data. For the Euro, Germany’s Producer Price Index (PPI) for July came at 5.3% MoM, which is higher than markets’ expectations.

For the technical aspect, RSI indicator is 24 as of writing, suggesting that the pair might witness some upside correction as the RSI stays in the oversold zone. As for the Bollinger Bands, the price continued to move alongside the lower band, therefore the downside traction should persist. In conclusion, we think the market will be bearish as long as the 1.0082 resistance line holds. But the pair could see some short-term correction before edging lower amid the oversold RSI.

Resistance: 1.0082, 1.0111, 1.0188

Support: 1.0111, 0.9991

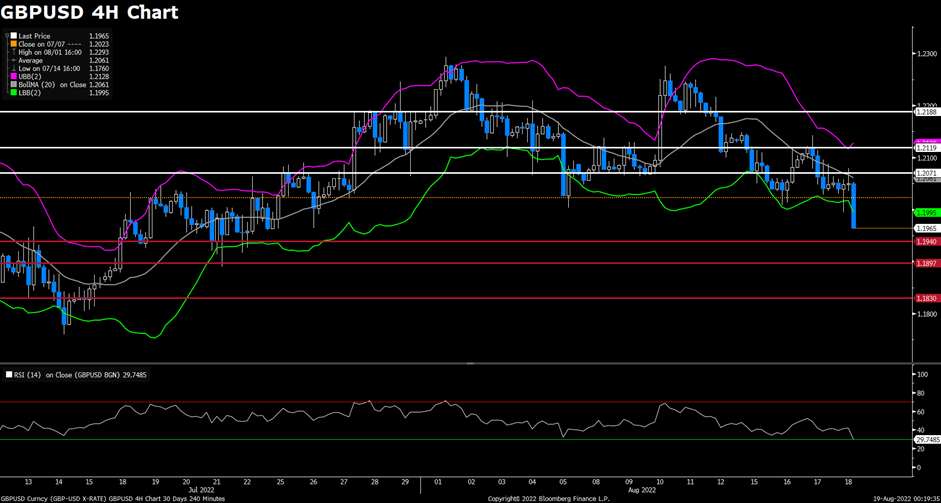

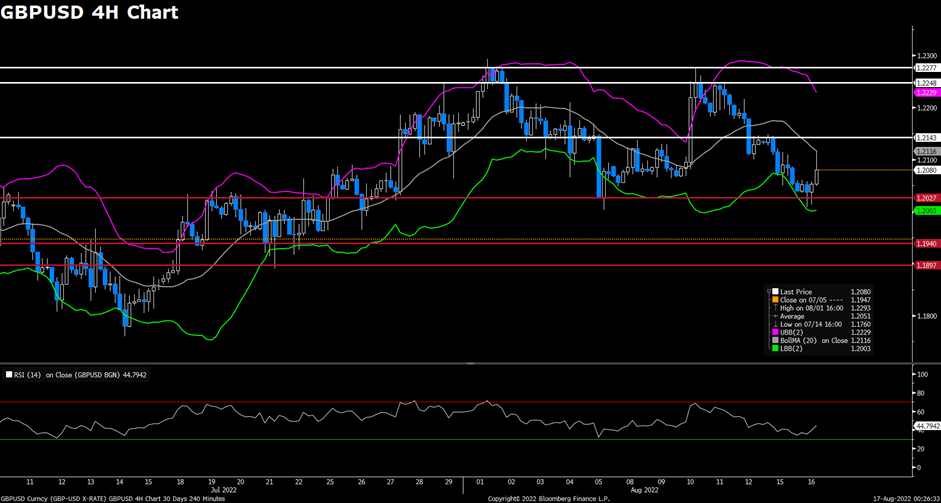

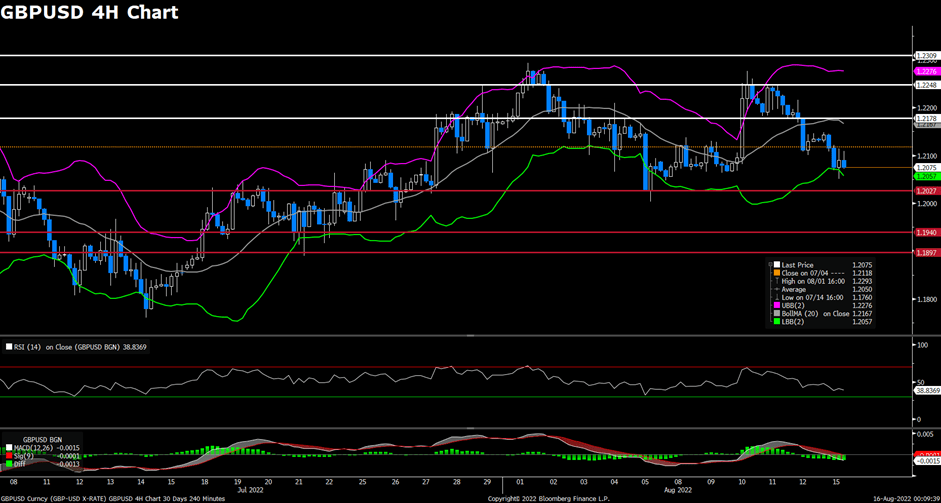

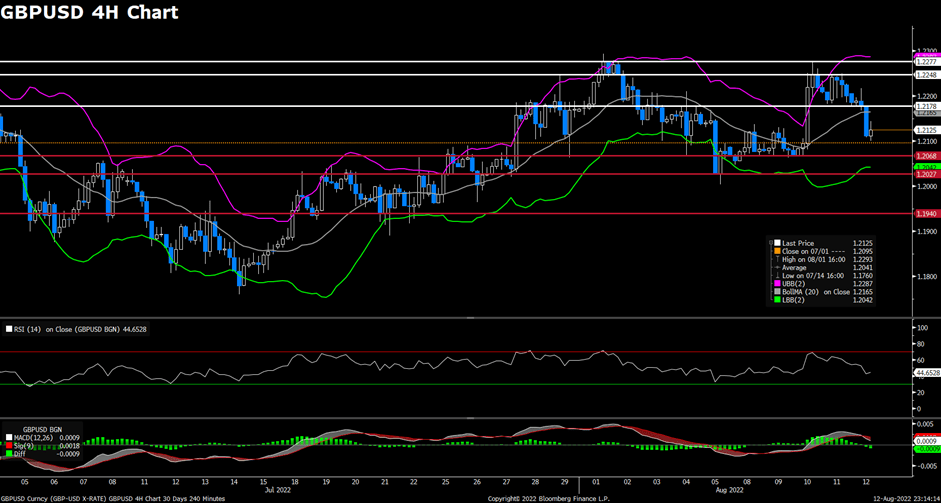

GBP/USD (4-Hour Chart)

The GBP/USD pair tumbled on Friday, coming under heavy selling pressure and dropped to a monthly low below 1.1840 level in the US trading session amid renewed US dollar strength. At the time of writing, the cable stays in negative territory with a 0.88% loss for the day. The prospects for further rate increases by the Fed and the prevalent risk-off mood both acted as a headwind for the GBP/USD pair, as the US central bank is expected to stick to its policy tightening path due to recent comments by several Fed officials. For the British pound, the better-than-expected UK Retail Sales rose 0.3% in July but failed to provide bullish strength to the cable, which is being weighed by the Bank of England’s gloomy economic outlook and a possible recession that would start in the fourth quarter.

For the technical aspect, the RSI indicator is 30 as of writing, suggesting that the pair could stage a correction before extending its slide as the RSI dropped below 30. As for the Bollinger Bands, the price preserved its downside traction and move alongside the lower band, therefore a continuation of the downtrend can be expected. In conclusion, we think the market will be bearish as the pair is testing the 1.183 support. A break below that level could drag the pair toward the next support at 1.1780.

Resistance: 1.1922, 1.2050, 1.2119

Support: 1.1830, 1.1780

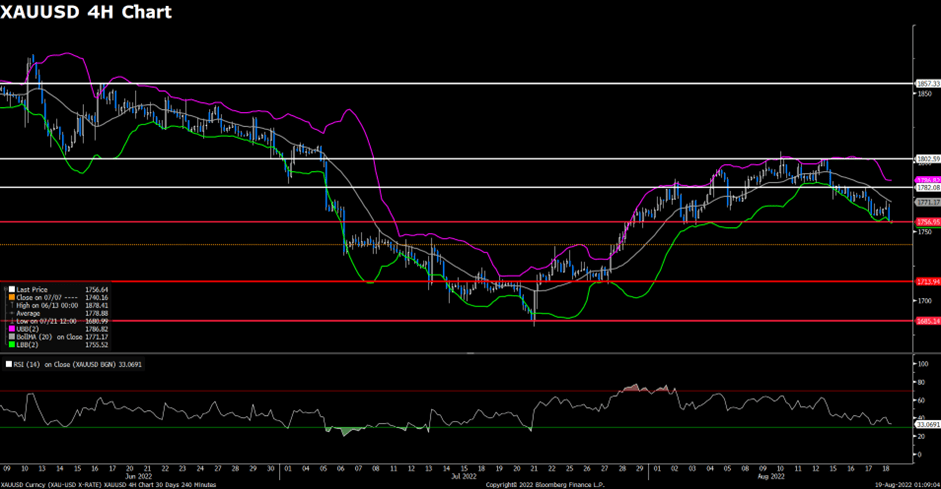

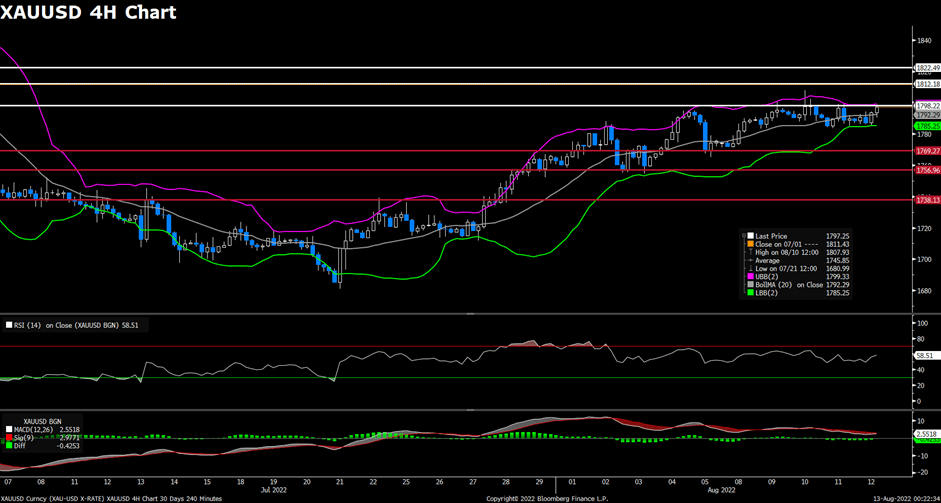

XAU/USD (4-Hour Chart)

Gold price declined to $1,750 during the European trading hours on Friday. Price continually slumped to below $1,750 in the US session after managing to erase its losses in the late EU session. With the 10-year US Treasury bond yield rising on the trade of the day and a stronger US dollar, the gold price seems hard to gather bullish momentum. Any further advance is taken as a selling opportunity by investors now.

From a technical aspect, the gold price drops below the $1,757 support level, and it turns out to be the pressure level to the upside. RSI indicator is 32 as of writing, suggesting downside momentum. As for the Bollinger Bands, the price tumbled along with the lower bound, staying right above it rather than dropping into the oversold zone, which means a decline before is acceptable and further decline to the downside could be expected. In conclusion, the gold price has dropped below the previous support zone at $1,757 and failed to regain the losses. The price could head to the next pivotal support zone for gold at the $1,714 level, which is the most possible path for gold price from technical analysis.

Looking ahead, in absence of any top-tier US economic events, the repricing of Fed expectations will play a key role in the gold price action. For more price action, all eyes now turn towards the Fed’s Jackson Hole Symposium this week.

Resistance: $1,757, $1,783, $1,803

Support: $1,714, $1,685

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| CNY | PBoC Loan Prime Rate | 21:15 | 2.75% |